The animal spirits that have fueled and reinforced economic growth in recent years could evaporate.

Consumer confidence (which can move in tandem with stock market returns) has already begun to move lower and is at its lowest level since 2017. CEO Confidence, as measured by the Business Roundtable, has dropped to its lowest level since 2016. On the positive side, NFIB small business optimism has moved higher in recent months, though it is still shy of its 2018 peak.

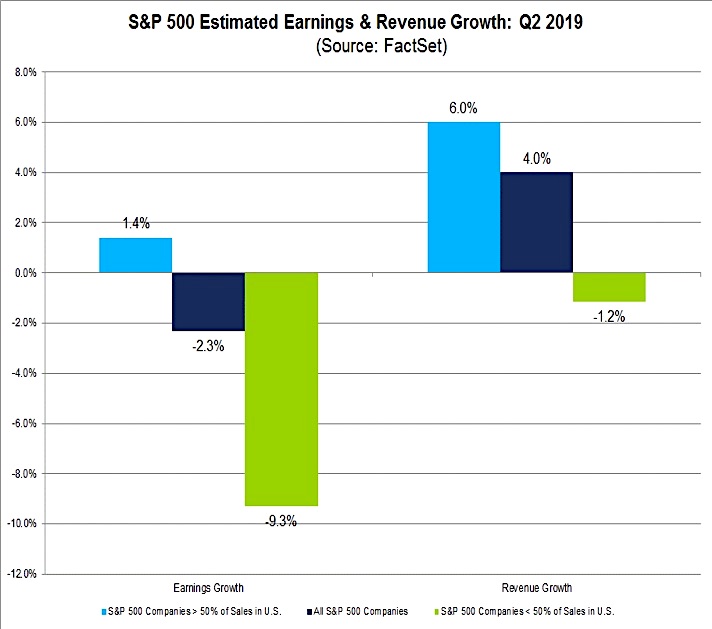

The disparity between the global economy and the U.S. economy can be seen in stark contrast when looking at expected corporate results for Q2. For the S&P 500 overall, earnings are expected to decline 2.3% in the quarter. Companies that get more than half of their revenue from within the U.S. are expected to see earnings grow 1.4%, while those that get a majority of their revenue from overseas are expected to see earnings decline by nearly 10%.

Revenue expectations show a similar spread, with 6.0% revenue growth expected for domestically-focused companies versus a 1.2% decline in revenue expected for those with elevated exposure to the global economy.

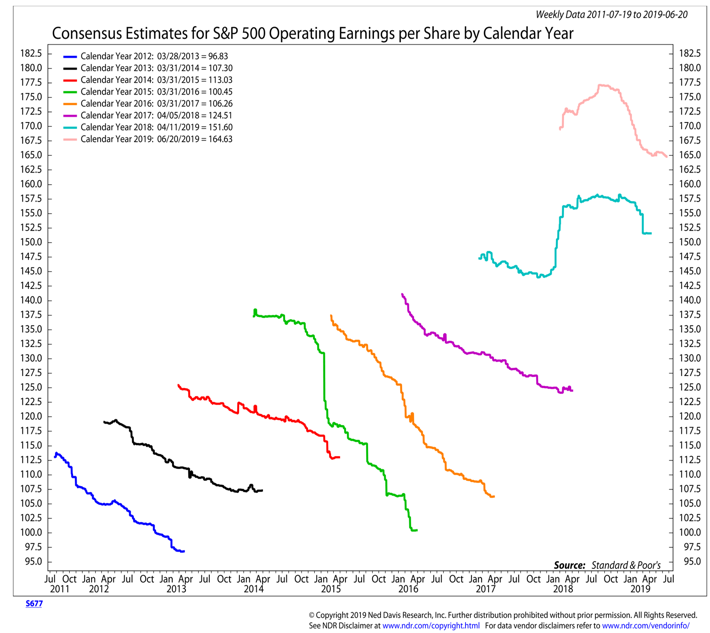

Overall earnings estimates for 2019 have moved lower as the year has progressed. With the exception of last year, this is a fairly reliable pattern. Evidence that the economic growth scare has been fully accounted for would signs that earnings estimates are stabilizing or even moving higher. Consistent with this would be a broad move higher in the economic surprise indexes. As mentioned above, that is being seen in the overseas indexes. Economic surprises in the U.S. continue to be to the downside.

Lower estimates for earnings are not an altogether bad thing. Reduced expectations provide a lower bar to clear and the S&P 500 typically does better when expected earnings growth is muted than when it is elevated.

Moderating earnings expectations need to be placed within the context of a longer-term valuation picture, which offers a less than bullish perspective. There is positive correlation between the median earnings yield (which is the inverse of the Price/Earnings ratio) on the S&P 500 and stock market returns over the ensuing decade. In the wake of robust price gains over the past decade, the current earnings yield for the S&P 500 is in the lowest quintile of readings.

Historically this has been is consistent with weak returns for stocks over the following ten years. There is no way at this point to know what the next ten years will hold in terms of stock market returns, but from a valuation perspective, expecting a repeat of the past 10 years would seem to be unreasonable.

At first blush, weekly equity fund flows suggest an awareness of this and reflect increased skepticism on part of investors. Even after a late-2018 surge in outflows ($100 billion over the course of four weeks) and the equity market gains seen over the course of the first half of the year, inflows have been slow to return. Outflows were quick to reemerge when stocks weakened in May.

The fund flow data might suggest that aggregate exposure to equities is historically low and/or exposure to cash is historically high. Comprehensive data from the Fed suggests that the opposite is true. Household exposure to both bonds and cash, as reported in the Fed’s quarterly Financial Accounts report, has drifted lower over the past decade. Aggregate exposure to equities has risen from 36% to 54%. Why that allocation is elevated (whether through active re-balancing, or a lack thereof) is of less importance than the fact that it is elevated. While shy of previous extremes, it is nonetheless in the highest quintile of historical equity exposure. History argues for subdued stock market return expectations in the coming decade based on currently levels of equity exposure.

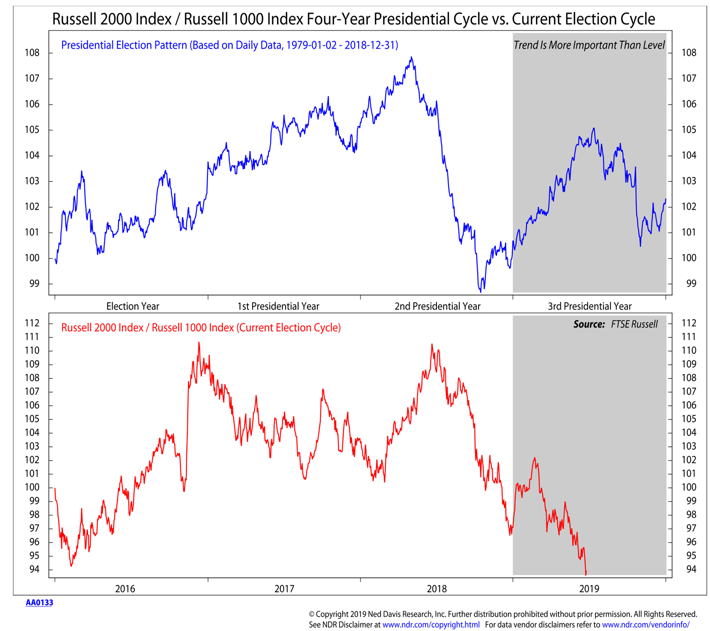

Current levels of market-related noise could be rendering seasonal patterns and trends less reliable than in the past. We can see this manifesting itself as the small-cap/large-cap ratio has deviated from its typical experience over the past nine months. While the overall cycle composite for 2019 suggests stocks could benefit from a seasonal tailwind into the fourth quarter, would are looking for more persistent confirmation that expected trends are reasserting themselves before putting too much weight on prospective signals.

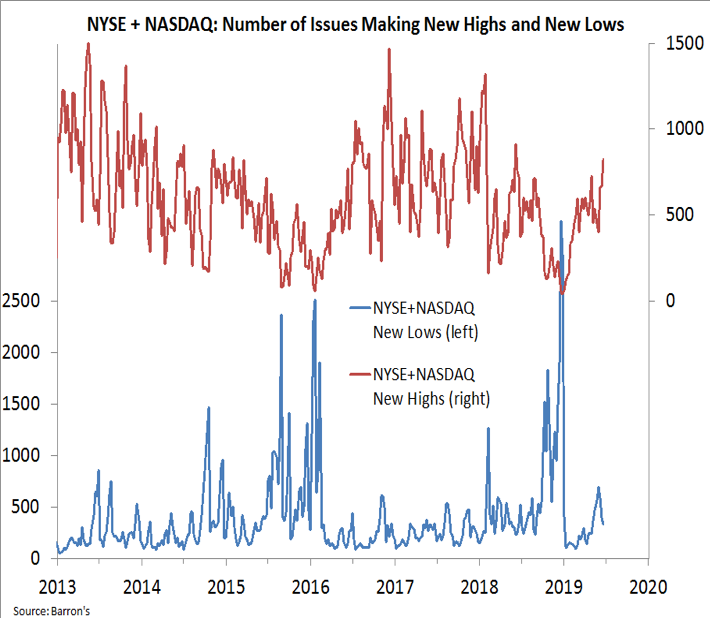

Expectations for positive returns in the second half of 2019 are contingent on the resiliency of the U.S. economy and evidence of a better breadth backdrop. Simply put, we need to see broader rally participation to have confidence that the price gains registered by S&P 500 are able to persist.

The strongest case would come from broad market measures strengthening ahead of the S&P 500, though as expressed in recent market commentary, even just confirmation (if not leadership) would be welcome at this point. One recent area of encouragement has been the expansion in weekly new high list. The combined new highs on the NYSE + NASDAQ made a higher high, climbing to its highest level since early 2018.

As encouraged as we are by the expansion in the new high list, we are troubled by more persistent theme of market breadth divergences. Our industry group trend indicator has made a series of lower highs as the S&P 500 has made new highs over the past 18 months. In part, this reflects weakness that is being seen at the small-cap and mid-cap level. But even among large-caps, breadth is less than robust. The percentage of S&P 500 stocks trading above their 200-day averages has not confirmed index-level strength. Additional evidence of improved market behavior would be to see a leadership rotation from Information Technology to Industrials and from Utilities to Financials, as both turns would argue for an improve growth backdrop.

While domestic breadth indicators have shown hints of strength in 2019 (including early-year breadth thrusts), the global broad market backdrop has remained more of a challenge. Primary among these indicators is the percentage of markets that have rising 200-day averages. While expanding from its early-year low below 20%, this indicator has stalled shy of 40%.

Over the past thirty years, virtually all of the net stock market gains from a global perspective have come when more than half of the individual markets were in up-trends (defined by rising 200-day averages). Evidence that this now 18 month-old period of cyclical volatility and weakness is coming to a close would be seeing an uptick in domestic and international rally participation.

We want to finish where we began, stepping back and thinking about the economy from a longer-term perspective. The seeds of the sub-par growth seen during the ongoing decade-long expansion were sown in the persistent downward trend in productivity growth that emerged in 2000. As the expansion has aged, the trend in productivity growth has turned higher. This is encouraging evidence that a secular shift in the economy has been taking place. Even accounting for periods of cyclical weakness (whether slower growth or mild recessions), the growth trajectory to which many have become accustomed may soon become a thing of the past (especially if the expansion is able to survive the current growth scare).

The encouraging news offered by the productivity data is offset by federal government budget projections. While any forecast needs to be looked at skeptically, it is nonetheless troubling that after a decade of economic growth we are facing annual budget deficits in excess of $1 trillion for as far as the forecast extends. Excessive levels of government debt may not be a specific catalyst for weakness, but it could reduce flexibility in periods of stress and is a sad commentary on the approaching to governing that is coming out of Washington DC. It does not instill confidence in the fiscal policy authorities.

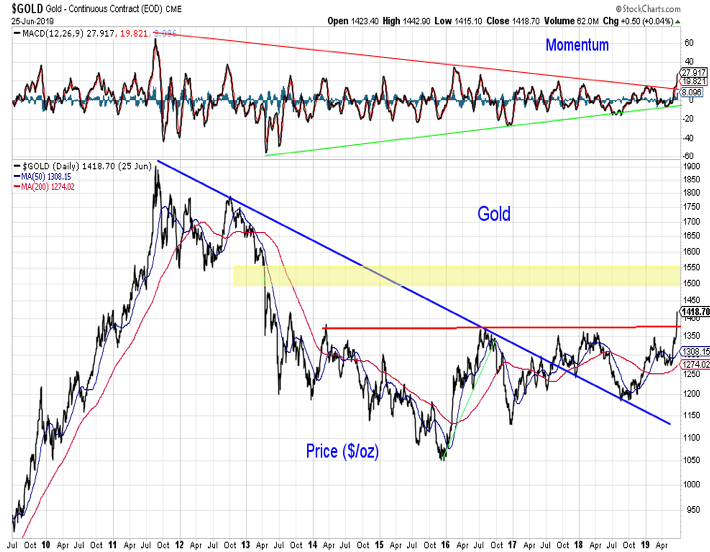

The challenge to the credibility of both the fiscal and monetary policy authorities is likely reflected in the recent action in the price of gold (and perhaps, bitcoin). Gold has broken above a well-tested resistance area that stretches back five years. Gold strength is not evidence of economic confidence or vitality. When this period of uncertainty ends, gold prices might as well. But until, gold could continue to benefit from building skepticism after a period of deep-seated complacency.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.