Financial Markets Highlights:

- Central Bank Easing Supports Stocks

- Economic Uncertainty Could Weigh On Confidence

- Earnings Estimates Moving Lower

- Household Equity Exposure Remains Elevated

- Noise Disrupting Seasonal Patterns

- S&P 500 Index (INDEXSP: .INX) Struggling To Find Broad Market Support

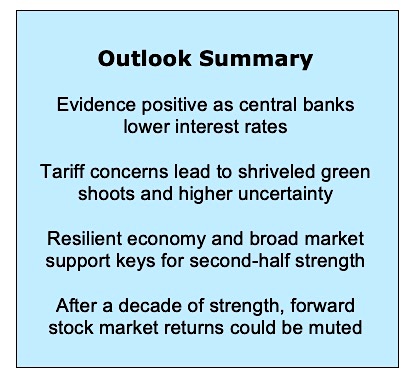

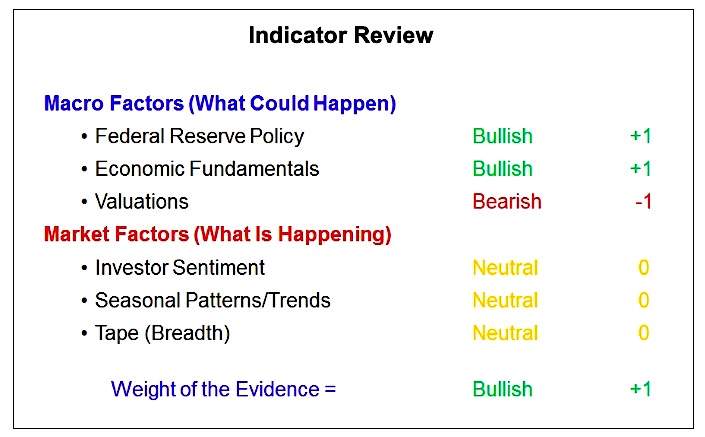

The first half of 2019 saw the weight of the evidence to improve to neutral following the emergence of early-year breadth thrusts, and then to slightly bullish as central banks have turned more accommodative.

While the evidence has improved and the first half of 2019 witnessed new highs on the S&P 500, risks remain elevated. Our focus now needs to be on the second half of the year, what it might hold, what we are paying closest attention to, and what investors can do about it.

While it is tempting to pay close attention to the market events of each day, the current environment has more than its share of noise and distractions. In answering a recent question about the FOMC’s Dot Plot, Fed Chair Jay Powell cautioned that paying too much attention to each dot could cause one to lose track of the larger picture.

The same can be said when looking at the impressionist paintings of Monet or Pissarro. Paying too much attention to each brushstroke can distract from the larger picture. An initial encouragement for the second half of 2019 is to look past tweets about trade policy and tireless dissections of uncertain comments from the Fed. Keep the bigger picture squarely before you.

In the wake of a more friendly central bank backdrop, we are looking for resiliency from the U.S. economy after a decade of expansion and evidence that stock market strength goes deeper than just headline index-level returns.

Before proceeding, a word of caution: While the past decade has produced strong results for those resilient enough to remain engaged with stocks, returns for the next decade may be more muted. With stock market valuations elevated and with households, institutions, and foreign investors having historically elevated exposure to equities, now may not be the time to think about aggressively moving from cash to stocks.

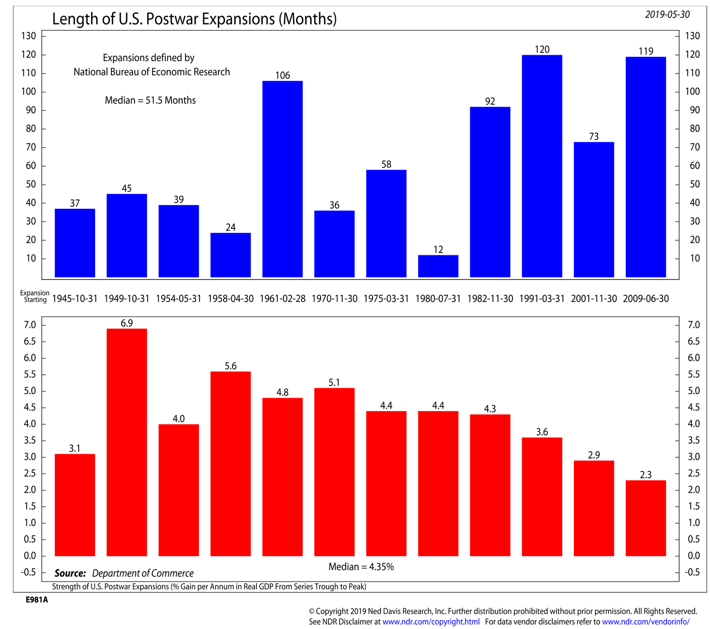

As we move into the second half of 2019, we mark the 10-year anniversary of the current economic expansion. While this makes it the longest on record, it is also the weakest on record in terms of average growth. Expansions do not die of old age, but risks have been on the rise. The resiliency of the expansion is likely to be tested as we undergo a near-term growth scare, but recession risk remains low for now. As shown below, the last 18 months in the stock market have been uneven. But even with those struggles, the stock market is sitting atop a decade of plenty, as we marked the 10-year anniversary of the March 2009 lows earlier this year.

After an initial peak in January 2018, the S&P 500 has gone on to make further new highs in September of 2018, April 2019 and June 2019. While new highs get celebrated (and historically they are a signal of strength), the 8.5% gain for the S&P 500 over 18 months is unremarkable especially in light of the rocky path it has taken to get there.

Of greater concern, and an area of focus for the second half, other measures of the stock market have not echoed the S&P 500.

International indexes (EAFE and Emerging Markets) as well as a broad index of US stocks (Value Line Geometric Index) are down over the past 18 months. How one feels about the market may be dependent on which of these indexes is being followed. With consumer confidence becoming more closely correlated with stock market performance, this could also impact views on the economy.

continue reading on the next page…