Equity markets can be fickle. The fourth quarter of 2018 saw a double-digit correction on the S&P 500 (SPY) and Nasdaq 100 (QQQ) driven by concerns over how quickly global economic growth was slowing.

While partially justified, it appeared to be an overreaction to the downside.

Since 2019, we have enjoyed a huge bounce back, partly due to the stock market being oversold and partly due to the U.S. Federal Reserve back- pedaling the path of monetary policy.

This rally was interrupted last week as concerns over the U.S./China trade dispute escalated. The market appeared to be convinced that a deal would be done, but with a few tweets and now a few billion dollars in tariffs later, uncertainty has returned. And markets do not like uncertainty.

Tariffs are dumb and apparently people are easy to fool. President Trump claims tariffs will be paid by China. While perhaps true in the literal sense – the Chinese exporting company physically pays the tariff – this is largely passed through to the buyer in the form of higher prices, which means the end consumer (in this case the U.S. consumer) pays most of it. That fact has not been mentioned at recent political rallies.

Or maybe this is all gamesmanship with the U.S. trying to apply more pressure to get better terms. If it is the “Art of the Deal” versus “The Art of War”, my money is on the ancient Chinese military treatise, which has sold a lot more copies. Alternatively, this could be political brinksmanship – nothing galvanizes folks like having a common foe.

This uncertainly could escalate, or it could dissipate just as quickly. That is why underlying fundamentals remain more important. Looking beyond the short-term volatility prompted by uncertainty, the fundamentals often provide a more reliable longer-term guide.

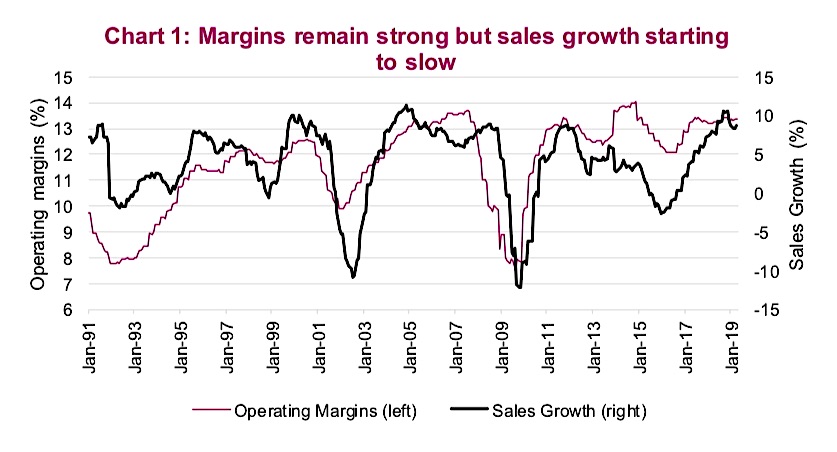

We continue to believe that at this stage of the market cycle, with some wage pressure, the slowing pace of economic growth and a stronger U.S. dollar, corporate margins remain very important. In fact, we highlighted margins a few months back as one of our market cycle indicators, and currently see them taking on greater emphasis. In this Ethos we will provide an update given the end of another earnings season.

Why are Corporate Margins More Important Now?

Global economic growth, including the U.S. and Canada, has been gradually moderating for the past year. This translates, with a few more moving parts, into slowing sales growth. We believe the market can likely handle this without too much angst, but if margins also contract, this could create faster earnings growth deceleration. Plus there is also the behavioral perspective. Pretend you are a Chief Financial Officer (if you are a CFO just be yourself), and your company is seeing some slowing of revenue and margins are falling.

What would you do? Probably cut costs, slow down hiring, hold off on funding new projects, travel less often, arrange fewer team lunches, maybe let some people go. Now imagine many companies are doing this. It begins to create a negative feedback loop that could very well cascade into a recession. Now that doesn’t happen overnight, but contracting margins may just be an early signal.

The good news from Chart 1 above is that while sales growth has slowed, aggregate index margins remain healthy. And this trend appears evident in first-quarter results at the individual company level. 53% of S&P 500 constituents that have reported earnings, saw margins improve over the previous quarter. That may not sound exciting but over 50% is over half.

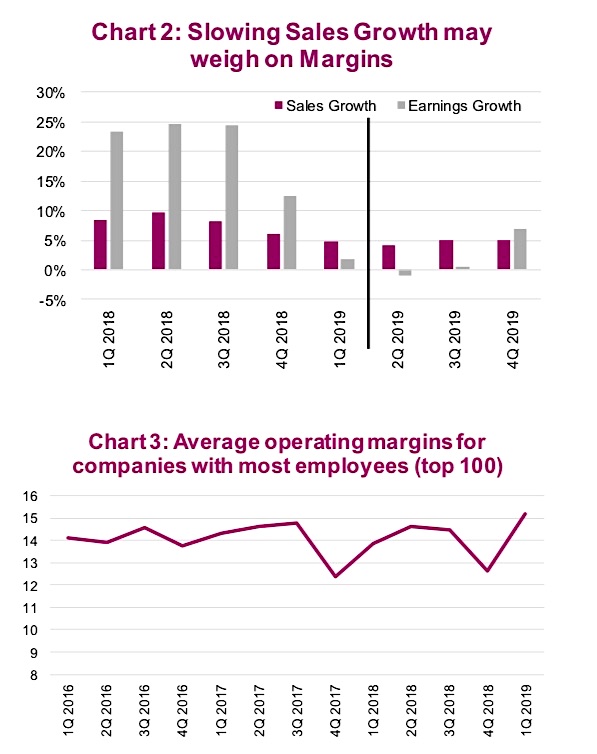

There are growing concerns for the coming quarters. Sales growth averaged 8% in 2018 and is expected to slow to 4.7% in 2019. Slowing economic growth is the primary culprit plus a strong U.S. dollar. Chart 2 below includes sales and earnings growth for the past few quarters and consensus forecasts for the next few quarters. The next few quarters may be tough with sales growth slowing.

Margins are also impacted by costs, notably labor costs. The good news at the moment is that while wages are rising, the pace is tempered. And productivity has been gaining in the past few quarters to offset the higher labor costs. For now, this has limited cost pressures on margins. Chart 3 above depicts average operating margins over the past few years for the 100 U.S. companies with the most employees. If labor cost pressures mount, it would likely be felt by these companies first.

Conclusion

For now, margins remain healthy and above historical averages. And while there are some coming headwinds as the year progresses, improvements in global economic growth and/or a falling U.S. dollar would help mitigate. This has us in the cautiously optimistic camp, but we also believe this data should be watched closely during future earnings seasons.

Source: all charts are sourced to Bloomberg & Richardson GMP

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.