Progress To Build On: Improving Economy Into 2017 Should Provide Tailwind For S&P 500 Index (INDEXSP:.INX)

New presidential terms are usually filled with policy uncertainty as the promises of the campaign give way to the realities of governing. Although unified Republican control in both houses of Congress and the White House may seem to suggest 2017 will be an exception to this pattern, the timing and scope of specific policy implementation remain subject to the typical Washington, D.C. sausage-making process. Rather than get mired in the details of potential program and policy changes that may (or may not) occur, our view on the economy for 2017 and beyond focuses instead on the following:

- The seeds for a sustained upswing in economic growth appear to have already been planted. The inventory correction that was a drag on GDP growth for five consecutive quarters has run its course and export growth has resumed. While the pace of job creation slowed in 2016, this appears to be more related to a lack of available skilled workers than an absence of opportunities. Wage growth accelerated in 2016 and the number of job openings remains near a record high.

- Republican control of both houses of Congress and the White House has raised hopes for significant tax and regulatory reform. This hope alone (to say nothing of actual progress) could be sufficient to raise CEO confidence, leading to an increase in capital spending that could fuel a resurgence in productivity growth. This could help fuel continued wage growth and could support GDP growth in the vicinity of 3% over a protracted period of time. While seemingly far-fetched now, this level of growth was more the rule than the exception in the not-too-distant past.

Taken together, this suggests the United States may well be on the cusp of a new growth paradigm. If this indeed comes to pass, its having begun even before the new administration takes office (or was even elected) could be a detail that gets lost in history. The lack of 2017 forecasts calling for a productivity growth-fueled secular shift higher in economic growth does not reduce its likelihood of occurring, in our view. Economic forecasts are often wrong, especially at inflection points associated with an acceleration (or reversal) in an underlying trend.

Positive surprises from the economy can become self-reinforcing and can help fuel better-than-expected corporate results. After a sustained period in which forecasts (for economic growth, corporate earnings, interest rates, etc.) have started high and worked lower over time, we may be entering a period in which forecasts need to drift higher to catch up with reality. This may compel the Federal Reserve to modestly accelerate its pace of interest rate hikes (over the single 25 basis point hike seen in both 2015 and, in all likelihood, 2016). We could also finally see stock market valuation relief as earnings growth rebounds.

Two longer-term sentiment trends bear watching: from an asset perspective households have elevated exposure to stocks and relatively little cash on the sidelines but from a flow perspective it is equities that are finally starting to see inflows and bonds that are seeing outflows.

2017 Stock Market Outlook: S&P 500 Index

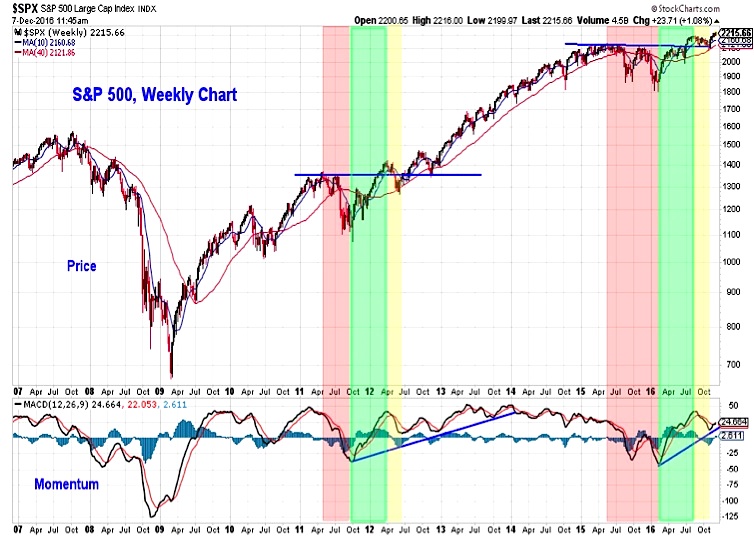

From a seasonal perspective, stocks enjoy a tailwind in the first half of 2017 but the road becomes rockier in the second half of the year. A key consideration from a seasonal perspective for 2017 is whether the historical pattern of reduced fiscal and monetary policy in the first half of a President’s term is repeated. Among the more important technical developments of 2016 was the cyclical bear market low that was made in February. So while it is true that the S&P 500 has not experienced a 20% pullback since its 2009 low, we have nonetheless experienced two cyclical bear markets (as defined by Ned Davis Research) in that time period. This means that as we move toward 2017, the current cyclical bull market is less than one year old (and within secular-bull markets, these rallies average more than two years in length).

Breadth has improved as stocks have rallied in the fourth quarter of 2016

An increased number of industry groups are participating in the rally and the Dow Transports are confirming the strength seen from the Dow Industrials. Continued improvement on this front would be a tailwind for the popular averages and help build on the momentum that occurred over the course of 2016.

While we can use these annual outlook pieces to cast an eye to the future and spend time considering what might be, our actual investment decisions must remain firmly within a disciplined process where this is balanced against what is actually being seen. To do this, we need to place these considerations in the context of our weight of the evidence framework. We will conclude with investment themes that we are focused on for 2017.

Federal Reserve Policy is neutral. There is little evidence (after a single 25-basis-point rate hike in 2015 and another likely to close out 2016) that the Fed plans on pursuing an aggressive rate hike path. The caveat is that if economic growth is accelerating, the pace of tightening may have to increase as well. After several years of downward revisions to the projected path of interest rate hikes, it will be curious to see if this changes in 2017. Either way, with a renewed focus on economic growth (and fiscal policy), the market may be less hung up on every utterance of Fed officials in 2017.

Yields across the Treasury curve bottomed in mid-2016 (with the Brexit vote as a convenient cover-story) and long-term downtrends were challenged as yields climbed in the second half of the year.

According to research by the Fed, the best index of consumer prices for gauging the trend in inflation is the median CPI (as calculated by the Cleveland Fed). The yearly change in the median CPI moved to its highest level since 2008 in 2016. This too could put pressure on the Fed to accelerate its pace of tightening.

We do not expect either bond yields or inflation to run away on the upside, but some continued upward pressure in 2017 seems likely.

Economic Fundamentals Begin the New Year as a Bullish Tailwind for Stocks

The prospect of renewed economic growth comes as some forecasters have looked at the calendar and started to worry about the next recession. While recessions have emerged with a fair degree of calendar regularity over the past century, it is not the passage of time that makes them more likely. In fact, research from the Federal Reserve in 2016 suggests the exact opposite – the age of a recovery is not itself a useful indicator when it comes to predicting recessions. The probability of a global recession is falling and the probability of a U.S. recession remains minimal.

Instead of looking at the number of months since the last recession, one should look at underlying indicators of stress. Two principal pieces of evidence here are initial jobless claims and the slope of the yield curve. Neither suggests now is the time to look for recession. Jobless claims remain at or near multi-decade lows (depending on whether they are adjusted for the size of the labor force), and the recent rise in bond yields has steepened the yield curve.

A discussion of recession risk is akin to asking how bad are things. If looking for a meaningful upswing in growth, a better question to ask might be how good things are. The absence of initial jobless claims is encouraging. Even more encouraging is the upswing in wage growth seen in 2016. Overall, yearly wage growth is close to 4%, according to the Atlanta Fed’s median wage tracker. As evidence the skilled workers are relatively scarce, those switching jobs are seeing their wages grow at the fastest pace since 2007.

Yearly data on real median household income echoes this improvement. While still shy of the 1999 peak, real income surged in 2015, rising to its highest level since 2007 and showing the best growth in decades. While the pace of hiring has indeed slowed in 2016, the wage and income data suggest this is a supply issue (lack of available workers) rather than a demand issues (no job openings). While not always evident in the headline GDP data, this suggests that the economy has been laying the groundwork for improved growth in 2017.

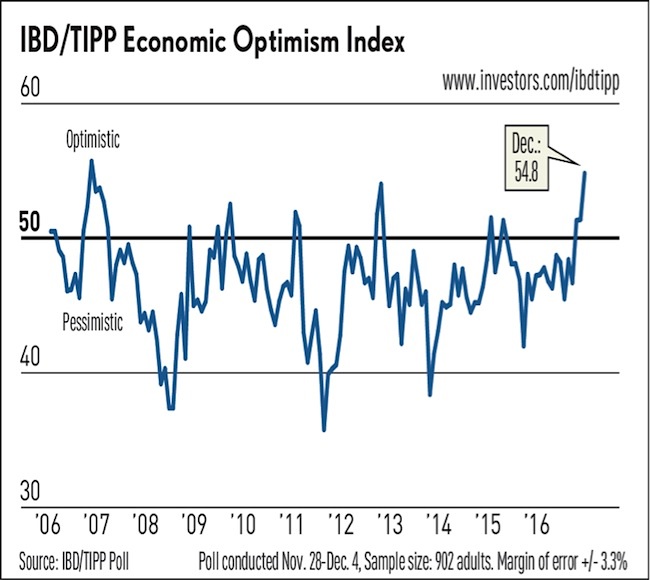

One missing ingredient had been optimism about the economy, but that now is changing. Economic optimism is finishing 2016 at its highest level in a decade.

continue reading on the next page…