There was a lot of good news for the stock market in 2017… and even some good news sprinkled in for the bond market. Our 2017 market review is brief, yet hits some major highlights.

2017 Market Review

Global central banks were either adding stimulus (Bank of Japan, European Central Bank) or holding steady (Federal Reserve) for most of the year. But, in any event, the financial markets cheered. And the U.S. lead the way as stocks took the escalator higher.

President Trump has just delivered on promises of corporate tax cuts, although much of that promise (and news event) has been priced into stocks already. Low interest rates, low unemployment, and continued growth in Gross Domestic Product added to the mix – and capital markets experienced strong growth for the year.

Going forward, the significant change on the horizon is the reversal of policy from the Federal Reserve for 2018 – they will be subtracting huge sums of cash from the financial system, $420 billion total scheduled for 2018, unwinding of the stimulus they added after the crisis. It remains to be seen if the short-term stimulus from the tax cuts, and existing growth momentum, will be enough to overcome the fast arriving headwinds from the Federal Reserve.

Stocks & Bonds

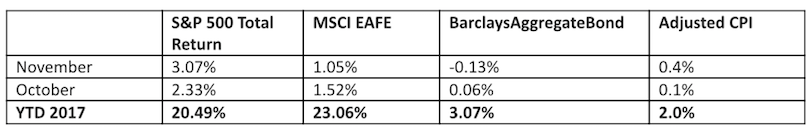

The Federal Reserve raised rates for a third time this year, maintaining pressure on bond markets. However, the stock market was fixated on imminent tax cuts. Inflation continues to be low by historical standards, and GDP continues to expand. Capital markets overall had a good year:

Commodities & Currencies

Oil prices climbed almost 6% in November, as a major supply disruption in the North Sea helped to push its gain to almost 7% for the year. They continue to stabilize near 2017 price highs. The safe-haven of gold has been volatile. After slipping for a couple months, gold is rallying right now. The U.S. Dollar declined almost 1.6% last month, and for the year is down almost 9%. Bitcoin got in on the fervor this year as well, but that parabolic ride has seen a 40 percent decline the past few days – lots of speculation there.

Economy

The ISM Manufacturing PMI in November was 58.2%, slightly lower than the October reading but still showing healthy expansion. The non-manufacturing, or services, index came in at 57.4%, also showing continued strong expansion. The Commerce Department released its third estimate of third quarter growth, estimating that the economy grew at an annual rate of 3.2%.

The National Association of Realtors reports that existing-home sales in November 2017 were 5.6% higher than in November 2016. In addition, the median price rose 5.8% to $248,000 from a year earlier. Median home prices have now been rising for the past 69 months. Distressed sales (foreclosures and short-sales) were just 4% of total sales in November, unchanged from last month and down from 6% in November of last year.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. The information is based on sources believed to be reliable, but its accuracy is not guaranteed.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

www.standardandpoors.com – S&P 500 information

www.msci.com – MSCI EAFE information

www.barcap.com – Barclays Aggregate Bond information

www.bloomberg.com – U.S. Dollar & commodities performance

www.realtor.org – Housing market data

www.bea.gov – GDP numbers

www.bls.gov – CPI and unemployment numbers

www.commerce.gov – Consumer spending data

www.napm.org – PMI numbers

www.bigcharts.com – NYMEX crude prices, gold and other commodities

https://money.cnn.com/2017/12/15/news/economy/obamacare-individual-mandate-tax/index.html – CBO estimates are different than others regarding Obamacare mandate changes

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.