In trying to understand and navigate the financial markets in 2017, one could be forgiven for feeling like a young Mel Gibson in the movie “A Year Of Living Dangerously” – as a neophyte reporter completely out of depth in a complex and hostile world.

Regardless of where you see yourself on the political, ideological, or any other spectrum, you would probably agree that the year was the most contentious and confusing in recent memory.

Political tone in the United States seemed to take a turn for the worse and government’s stand on issues such as healthcare, immigration, global trade, or environment became a cause of concern and angry confrontations.

Natural as well as man-made disasters seemed to reinforce the dour sentiment. The year’s Atlantic hurricane season was the deadliest and most damaging in history. Tragically, so was the mass shooting in Las Vegas.

Some optimists clung to the hope that the United States finally had an administration that would cut through years of legislative gridlock, roll back burdensome regulations, and deliver a long-promised reform of the tax code.

Okay, on to the 2017 financial market review with a few thoughts on 2018.

2017 in Financial Markets

Given the above, it is easy to assume 2017 was a difficult year for the financial markets as fretful investors sought safety. Several pundits actually predicted a global financial crisis following Trump’s election.

Economic forecasters were more optimistic, but at around 5%, the average 2017 consensus forecast for the S&P 500 was fairly conservative, see below (via Wall Street Journal).

Wall Street Journal 2017 Economic Forecasts. Source: The Fat Pitch

Economists certainly had good reasons to be conservative. Despite the supposedly business-friendly incoming administration in the U.S. there was no guarantee they would be able to successfully implement their campaign promises.

Additionally, persistently high US equity valuations were likely to be a significant headwind. Finally, a predicted rise in interest rates/bond yields or a significant pickup in inflation was to have a negative effect on equity prices.

A year later and with the dubious benefit of hindsight, it is clear these forecasts were way off the mark.

As 2017 unfolded, corporate earnings picked up across the board, inflation remained tame, and nearly all global economies were firmly in growth mode.

Contrary to expectations, 2017 turned out to be a decidedly strong year for financial markets.

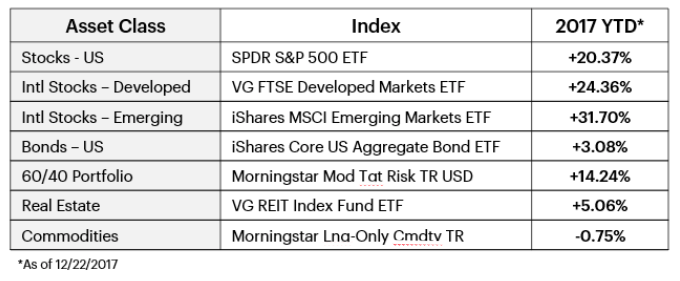

With a few trading sessions left in the year, the S&P 500 is trading more than 20% higher.

International stocks did even better. Emerging markets in particular gained more than 30% this year, narrowing some of the remaining valuation gap with the US equities.

Bonds and real estate were relative laggards, while commodities currently remain the only asset class that has not been able to stage a meaningful recovery over the last five years.

2017 Crypto-currency Craze

No review of the year would be complete without mentioning cryptocurrencies, with Bitcoin as their poster child.

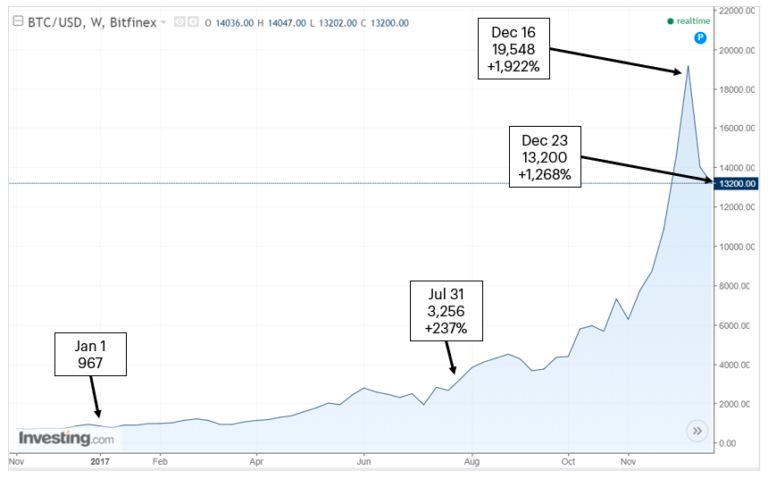

Bitcoin started the year under $1,000. By the end of July its price had more than tripled to about $3,260.

The eye-popping triple-digit return was not nearly enough. From here Bitcoin more than sixtupled reaching $19,500 in December, for an incredible +1,920% gain, although it has since pulled back somewhat.

As their prices rose, cryptocurrencies attracted increasing attention from the media, investors, and hordes of fortune seekers, some of whom made incredibly dubious claims.

The one that caught our attention and alarm was from a company called BitCoinIRA.com, whose press release had these choice quotes (emphasis ours):

“Thanks to [Bitcoin’s] truly global nature, it has a lower risk of collapse than more traditional investment assets, which depend on the strength of the dollar.”

“[BitCoinIRA.com is] a unique alternative to traditional IRAs for investors who are seeking to diversify their portfolio and protect their retirement savings and 401(k) plans.”

The above quotes try to make Bitcoin sound like a Treasury bill. Given the fact that Bitcoin has been 5-6 times more volatile than the S&P 500 and remains completely unregulated, any claim like this is irresponsible and downright dangerous in our opinion.

It is impossible to predict how the cryptocurrency story will end and what the ultimate peak Bitcoin price will be. The odds remain it will end in the same fashion as history’s other investment manias.

Onward and Upward in 2018?

December is the height of forecasting season and our inbox is brimming with “2018 Outlook” PDFs from nearly every analyst/asset management firm.

Overall, economists did not change their tune from a year ago. They are expecting 2018 to be another positive year with a median return for the S&P 500 in mid-single digits. Here’s a forecast via Barron’s:

Barron’s 2018 Economic Forecasts. Source: The Fat Pitch

Previously stated concerns regarding high US equity valuations and possible unwelcome pick up in inflation remain in effect but, once again, we do not know whether and how these will manifest themselves in 2018.

On the bullish side, fundamental and economic data remains favorable. The just passed U.S. tax bill should be favorable to corporate earnings.

Perhaps the best indicator that 2018 will likely be another strong year is not fundamental but technical. Most global equity indices currently have strong upside price momentum–they continue to break out to new highs and the advance remains broad (i.e. majority of individual stocks are moving higher in step with the indices).

The following quote from Richard Russell helps illustrate why this may be an important signal:

“True, valuations are absurd, bullishness is rampant and every magazine and newspaper lets you in on which mutual fund to buy. But this bull market has developed a tremendous upside momentum, and upside momentum does not die quickly.”

We believe this quote accurately captures the current state of the market, especially as it relates to valuations in the U.S. and upside momentum.

Keep in mind that Richard Russell wrote the above in 1995.

For those of you who were not around, 1995 was five (yes, five!) years before the ultimate top of the dot-com bull market.

Wishing you all the best in 2018.

Twitter: @KastelCapital

The author or his clients may hold positions in various securities that are mentioned in this article at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.