In an aging bull market with stretched valuations there is one antidote to a market pull back.

That antidote is growth.

The market has for a while now placed an enormous premium on growth and an equally, if not harsher, punishment on missed growth. Let’s look at the technology sector and see which firms are growing revenue the fastest in the last year.

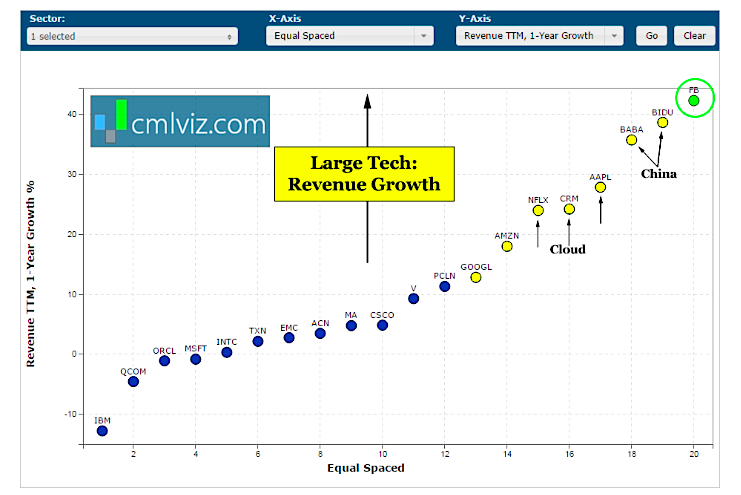

Let’s start with technology companies that have market caps above $50 billion and we will rank them on a scatter plot by one-year revenue growth percent.

Fastest Growing Tech Companies – Large Caps

It should come as no surprise that of the fastest growing tech companies, mega cap technology company Facebook (FB) is #1. What may indeed surprise us is that Baidu, Inc. (BIDU) and Alibaba Group Holding (BABA), China’s two darlings, show the second and third largest revenue growth year-over-year, respectively. Finally, surprise number three comes from Apple (AAPL) — yes, Apple is the fourth fastest growing mega cap technology company.

Rounding out the top eight we see Salesforce.com (CRM), Netflix (NFLX), Amazon (AMZN) and Google (GOOGL).

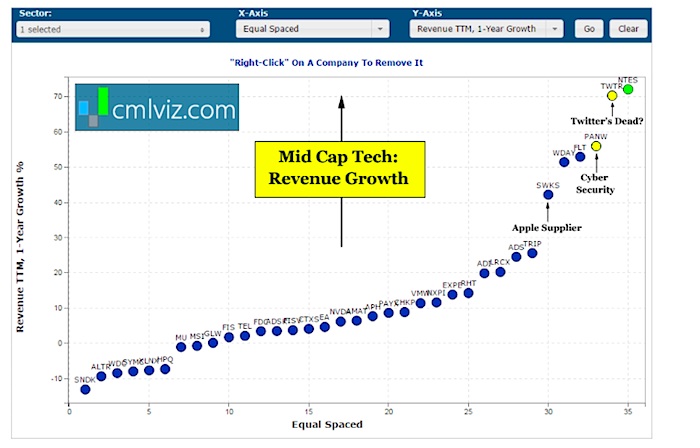

But of course, there’s an entire population of technology companies with smaller market caps. Let’s look at market caps between $10 billion and $25 billion, below.

Fastest Growing Tech Companies – Mid-Caps

NetEase.com Inc (NTES) tops the chart. Brace yourself for number 2… the most hated stock in the world, Twitter, Inc. (TWTR), is growing faster than all but one other technology company in this group.

That said, let us also not forget that Twitter just announced it will open up its advertising (revenue) engine to its roughly 500 million monthly non-logged in users (compared to its 320 million logged in users).

Peeking down the list of fastest growing tech companies (mid-caps) a bit further, we see one of my favorite cyber security stock picks, Palo Alto Networks (PANW) and one of Apple’s heaviest suppliers, Skyworks Solutions Inc (SWKS).

Why This Matters

The top analysts, asset managers and hedge fund managers across the globe are keenly aware of data that moves markets. They actually create their own valuation models to stay ahead of the game. If we’re not using this data, then we’re trading against people that have much more information then we do. That is a wealth losing strategy.

Note that we write one story a day over at CMLviz using visuals to break market news: Get Our (Free) News Alerts Once a Day.

Thanks for reading.

Twitter: @OphirGottlieb

The author has current positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.