Earnings

With just over 100 companies reported so far in the United States and the bulk of the Canadian earnings season just around the corner, we thought it fitting to have a look at how the season is progressing and what it’s all about.

Earnings are the beating heart of valuation and stock returns; by some models, stock prices are simply the present value of all future dividends (paid through earnings).

Earnings season can also cause a frenzy of activity as we get only four occasions a year to have a real look under the hood at how a company is performing. The results, along with comments from management, give a glimpse into the outlook, industry demand, pricing power (margins), and how companies are faring against the competition.

Moreover, the ways in which companies cope with dynamic industry pressures provide further indications of management competency.

So far, 113 companies have reported with most of the results proving decent. Though top line numbers in aggregate have missed expectations to a small degree, earnings are still surprising to the upside.

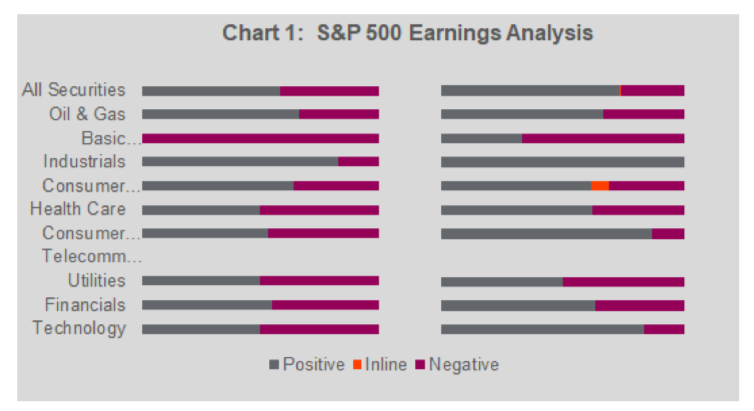

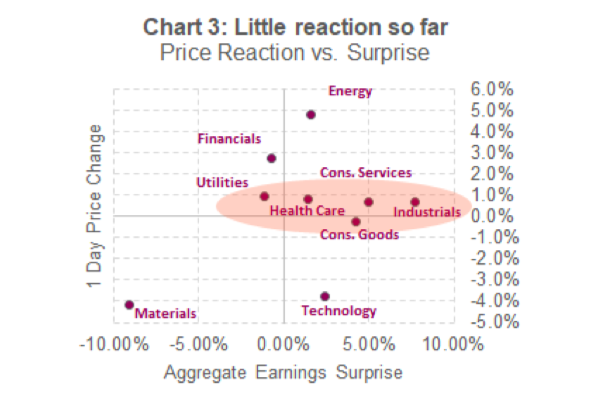

We have a -0.08% aggregate sales surprise, but 1.71% beating earnings forecasts. As Chart 1 below illustrates, within the sectors Industrials appear to be the clear winner in earnings beats. Interestingly, Energy companies and Financials have enjoyed the largest price appreciation on earnings days.

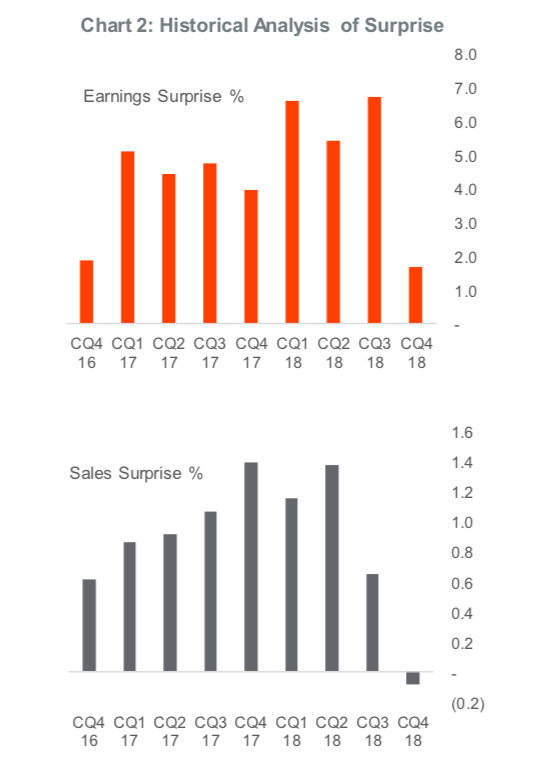

From a historical perspective, as you can see on Chart 2, the ‘beats’ this quarter are the smallest since the fourth quarter of 2016.

This is likely what has led to rather muted price reaction across most sectors. (Chart 3)

That latest report

Earnings season is a busy time of year for sell-side analysts. Fund managers, analysts, brokers and even retail investors are all eager to read from expert opinion on how a company is doing. Often, Research Analysts cannot publish quick enough to satisfy demand for a ‘deep dive’ account of the latest quarter. Over time, you may realize that most of these sell-side reports begin to look and feel the same. Quite frankly, research has become commoditized, but it’s still a commodity with demand.

There are limitations in the value of sell-side research but the popular narrative does it a disservice. Yes, ulterior motives (i.e. sensitive banking relationships) are sometimes present. But sell-side research is very useful in getting you up to speed on a new stock or sector, provided it does NOT dictate the entirety of your decision making process. Reports can also help in figuring out where the consensus likely is. Remember, alpha doesn’t just come from being different. You must be different and right. Determine the consensus view and decide if it’s a good time to disprove or bet against the crowd.

Actively seeking out opinions contrary to your own can promote better decision making. This is a great tool to combat Confirmation Bias, our innate tendency to seek out and pay more attention to information that fits with our existing preconceptions. We advise you seek arguments from the opposition and work through why you believe they’re wrong. Sell-side firms employ a lot of very smart people and varying your research sources is a great way to get those differentiated views. Key word though: differentiated.

Consensus

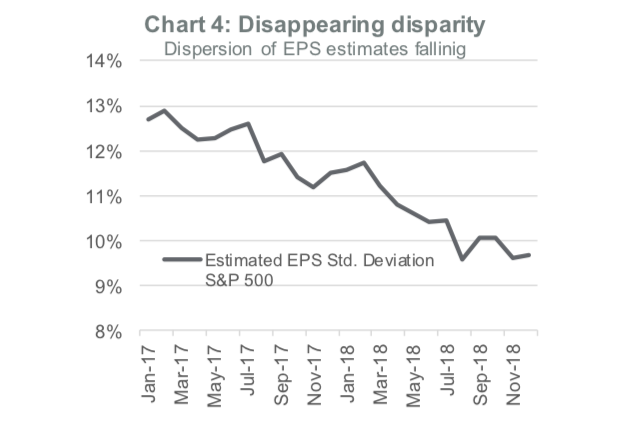

Dispersion is a measure of how in agreement analysts’ estimates are. Strong consensus occurs when the dispersion in forecasted earnings per share (EPS) is low, or in other words all the analysts are clustered together. What we’ve noticed is that dispersion of the contributed EPS estimates by analysts have been falling over time. Chart 4 expresses the level of agreement amongst analysts.

The lower standard deviation represents less dissent amongst the community. Merrill Lynch also reported that aggregate consensus for the S&P 500 is at an 18-year low, alluding to high confidence of the analyst community.

Why analysts’ estimates are so clustered is debateable. It could be that as we near the later stages of the bull market, growing uncertainty makes forecasting business trends a harder task. Alternatively, it could represent ‘lazy’ analysts all looking at the same data with the same models, and no one thinking out of the box. Does a particular analyst truly possess an expert opinion or are they just following the herd?

So does increased confidence/low dispersion indicate more certainty or better results? In some studies, the answer is, in fact, yes. Research shows that consensus opinion of expert analysts can add to the credibility of the view. When combined with earnings momentum (upward revisions), it can even be a predictor of future returns. In other words, in isolation, low dispersion can add credibility to a positive view. In aggregate however, when the entire analyst community is increasingly in agreement, we have to think that something else is going on.

Conclusion

As things become more uncertain, the potential for groupthink increases. Afterall, it’s hard to spot the black swans or grey rhinos if everyone is looking in the same direction. Relying on the experts is great when you want to get up to speed on a stock or industry. As this earnings season has shown, however, actual results don’t care about consensus and markets remain predictably unpredictable.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.