Annual fiscal deficits over $1 trillion will power economic growth with no consequences

- Current deficit equals 4.4% of GDP and is projected to rise to 5.5% in 2019 ($1.2T)

- Recent projections of budget deficits have been revised aggressively higher

- Interest expense rose 10% this past fiscal year and now accounts for $500 billion spending. To put that in context, the defense budget for 2019 is $717 billion.

Domestic political turmoil will not roil markets or inhibit consumer and corporate spending habits

- Mueller’s findings

- Mid-term elections

- The potential for the Democrats to take a majority in the House and/or Senate and advance calls for Trump impeachment as well as impede further tax reform and possibly other corporate-friendly legislation

Possible additional U.S. dollar appreciation and the resulting financial crises engulfing many emerging markets will not cause financial contagion or economic slowdown to spread to developed nations or to the world’s largest banks

Geopolitical turmoil will not roil markets or stunt global growth and trade

- Brexit

- Italy

- Iran

- Russia

- Syria

- Turkey

- Brazil

- Argentina

- Venezuela

- South Africa

The performance of U.S. stocks can diverge from the rest of the world

- The following developed markets are all negative year to date and have a 50-day moving average below its 200-day moving average

- United Kingdom -5%

- Japan -3%

- Hong Kong -9%

- South Korea -6%

- Germany -6%

- World Index EFA (blue) vs. S&P 500 (orange)

Trade wars and increasing tariffs benefit the economy and global markets

- China

- Canada

- Mexico

- Europe

- Japan

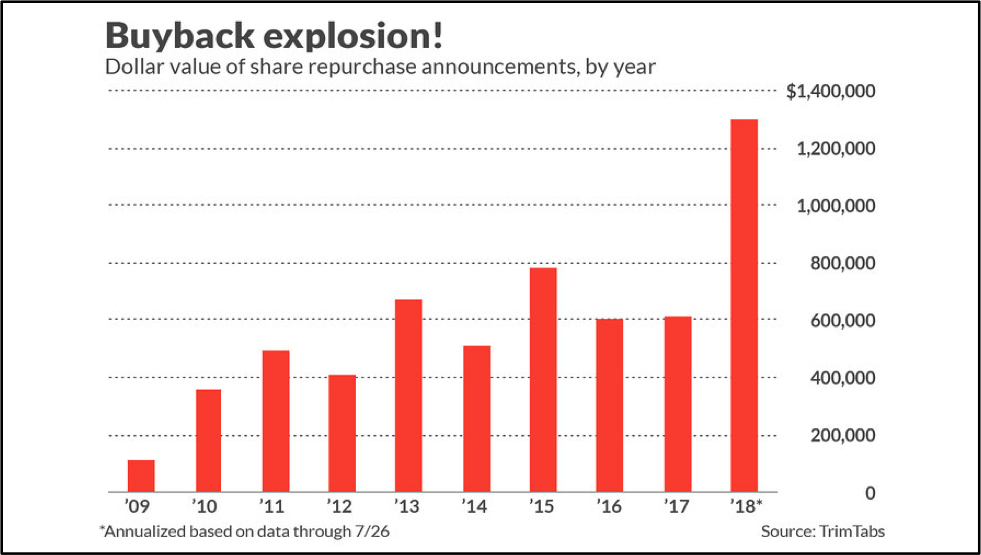

Corporations, via stock buybacks, will continue to be the predominant purchaser of U.S. stocks

- Buybacks will reach a record high in 2018

- Corporate debt can continue to rise to fund buybacks despite rising interest rates and risk of credit downgrades

- Corporate debt as a percentage of GDP is now the highest on record

Liquidity in the markets will remain plentiful

Central Banks can permanently prop up asset prices if they are to fall.

The most important factor long-term bulls must assume to be true:

This time is different

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.