As we turn the page to 2017 and a new year offers traders a clean slate, I thought it would be a good idea to share some research and bullish ideas on small cap stocks with upside.

These 13 stocks have market caps of $500M to $3B and are showing strong technical momentum heading into 2017. They also have strong fundamentals and are trading at a reasonable valuation for the growth.

There were dozens of regional banks and REITS, so I mostly avoided Financials and looked for relative strength across other sectors.

The majority of these names have very little analyst coverage and unknown to most investors, and over the years this is where I find the best investment opportunities. These are brief summaries and suggest diving deeper into earnings transcripts for a better understanding of each of these companies.

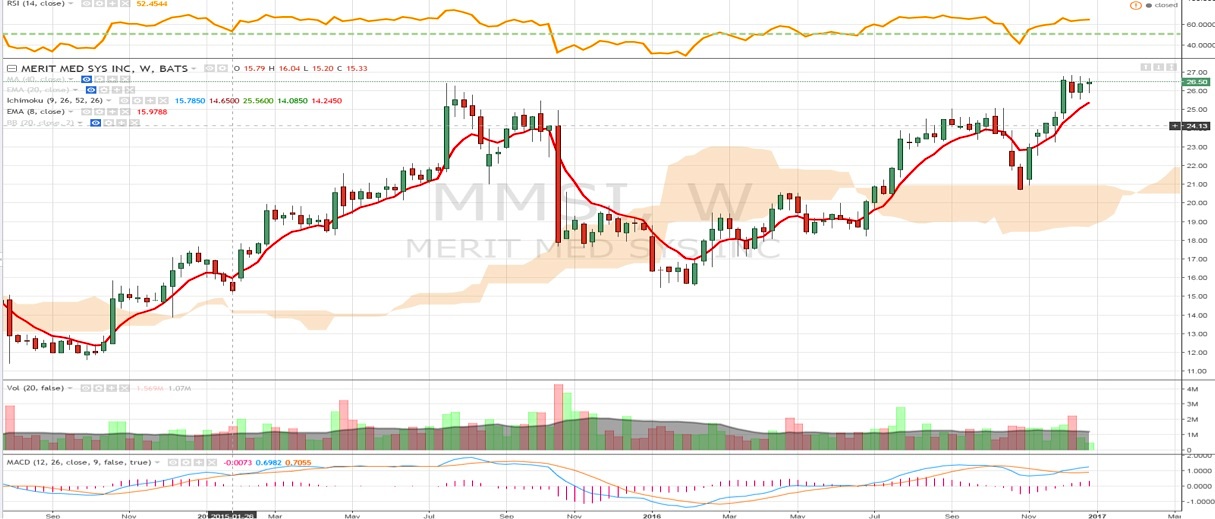

Merit Medical (MMSI)

Merit Medical (NASDAQ:MMSI) is a $1.17B maker of medical devices for interventional and diagnostic procedures trading 23.25X Earnings, 2X Sales and 2.4X Book with a strong history of growth. MMSI forecasts 9.3% revenue and 14.6% EPS growth for 2017. The company has seen some momentum with multiple 510 (k) clearances in 2H16 for new products. On the chart shares are coiling with a bull flag just below new highs after a strong November rebound off the rising 200 day MA. MMSI is launching a lot of new products in late 2016 that sets up for a strong year in 2017, and its three year plan of improving revenues and margins is well underway.

click to enlarge charts

NX-Stage Medical (NXTM)

NX-Stage Medical (NASDAQ:NXTM) is a $1.69B market of medical products for chronic and acute kidney failure. Shares trade 4.66X Sales and revenue growth seen accelerating with 9.9% in 2017 and 17.5% in 2018, and to reach profitability in 2017 at $0.03/share earnings. NXTM is a company benefiting from the strong growth in home healthcare while critical care is also posting solid growth. NXTM has consistently been beating estimates in 2016 and enters a new product development cycle next year. On the chart shares have trended higher much of 2016 and starting to move out of consolidation.

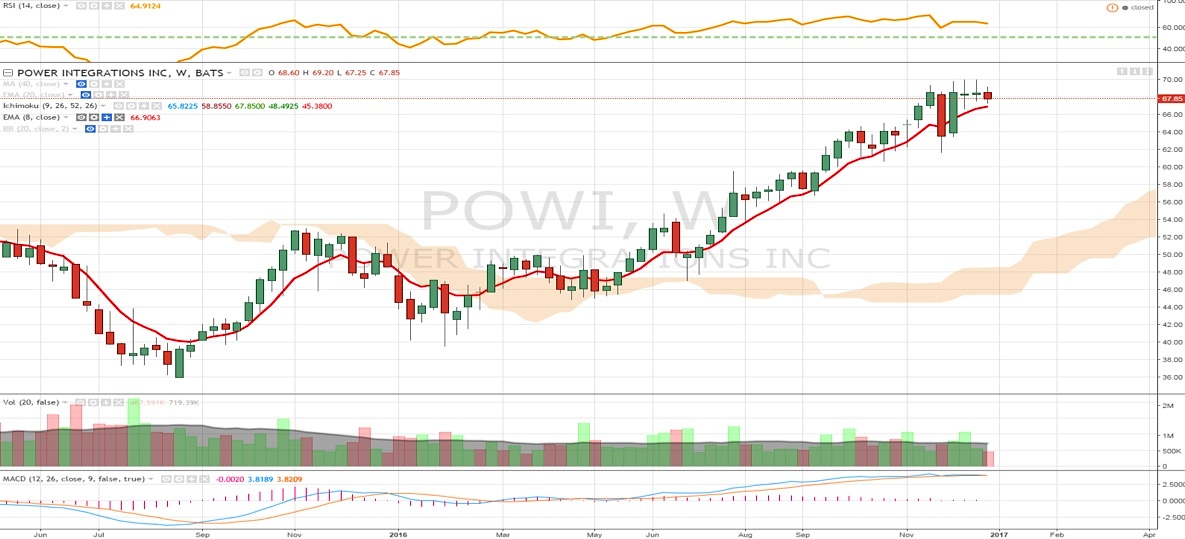

Power Integrations (POWI)

Power Integrations (NASDAQ:POWI) is a $1.97B maker of electronic components and circuitry used in high-voltage power conversion. Shares trade 23.9X Earnings, 5.27X Sales and 28.75X FCF with a 0.77% dividend yield. After 12.7% revenue growth and 20.5% EPS in 2016 the company is projecting similar results for 2017, an impressive growth story. POWI has a large addressable market needing energy efficiency and Industrial is its largest segment with LED lighting, Smart Meters, Wind/Solar inverters, etc., while Computer, Communications, and Consumer are its other major segments. On the chart shares trended higher following a May breakout and the last 6 weeks have consolidated just below new highs.

Wage Works (WAGE)

Wage Works (NYSE:WAGE) is a $2.65B provider of consumer-directed benefits platform trading 42X Earnings, 7.65X Sales and 15.15X FCF. WAGE growth tailed off in 2016 but expected to jump sharply in 2017 with its acquisition of ADP’s consumer health spending account. WAGE is positioned well as employer’s shift costs of healthcare onto employees, and employees are looking for tax advantages. On the chart shares are flagging just under new highs.

continue reading on the next page…