Rising interest rates have been the talk of Wall Street and Main Street for the past 2 years.

And just as many thought interest rates were peaking/plateauing, well, they seem to be breaking out again. Yikes!

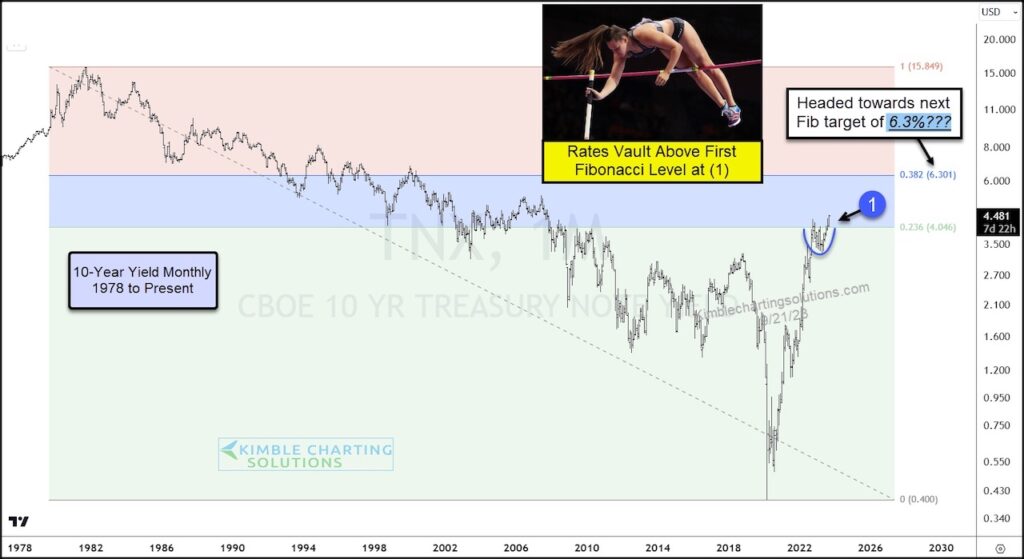

Today’s chart looks at a long-term “monthly” view of the 10-Year Treasury Bond Yield.

And as you can see, it is looking more and more every day that yields have cleared the first fibonacci level at (1), based upon all-time highs and lows in yields.

This breakout means that the next Fibonacci retracement comes into play at 6.3% – the 38.2 Fibonacci level.

That would be a 50% increase in interest rates above current levels….CRAZY! Stay tuned!

10-Year Treasury Bond Yield “monthly” Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.