Welcome to Q2! Things have moved fast since my original post (both in terms of market movements and the general consensus/sentiment). So I thought it would be helpful to take a quick progress check on the “10 Charts to Watch in 2021“.

In the original article I shared what I thought would be the 10 most important charts to watch for multi-asset investors in the year ahead (and beyond).

In this article I have updated those 10 charts, and provided some updated comments.

[Note: I have included the original comments from back at the start of the year, so you can quickly compare what I’m thinking now vs what I said back then]

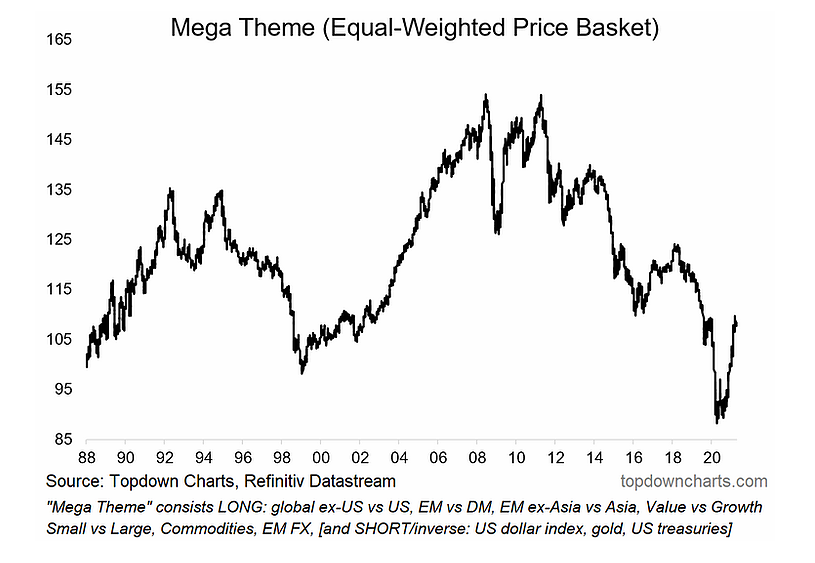

1. Mega Theme: This basket of ideas has been performing nicely, perhaps a little too nicely – indeed the breadth of performance almost got a little too overheated, and a couple of themes within it have taken a breather. I think it’s quite possible this basket does take a breather after such a roaring snap-back. Yet, the valuation picture remains positive, and I have yet to find good reason to discard any of the individual ideas – so aside from a possible consolidation/brief give-back, basically stay the course on this one.

“In the last regular edition of the Weekly Macro Themes report of 2020, I decided to combine all my big ideas into one “mega theme” given some of the echoes across the ideas in terms of price action and macro drivers. The result is this interesting chart which looks to be either at or near the bottom of a long-term secular trend, and the start of at least a short-term cyclical upturn.”

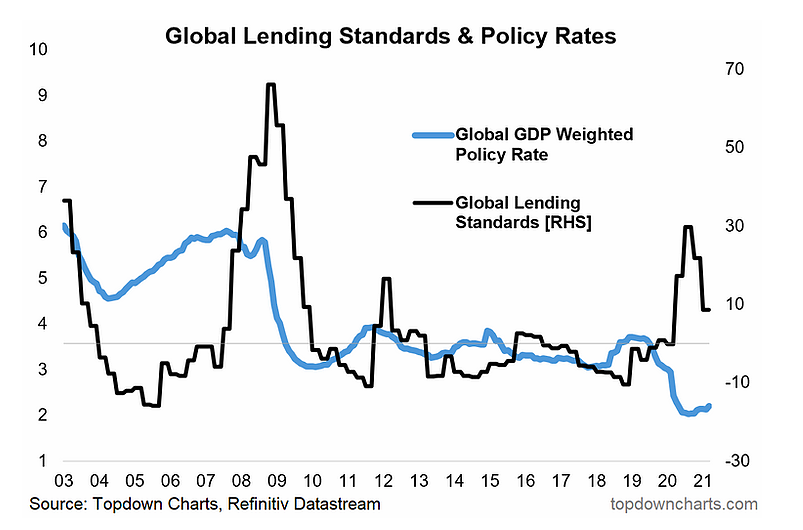

2. Monetary Policy (limits): Things have moved on a bit on the policy front, and indeed in terms of recovery there has been a lot more action (and talk) on fiscal policy. We likely see fiscal policy doing more heavy lifting, and so far there has been increasing focus on infrastructure and energy transformation… interesting stuff.

“The policy response to the pandemic was historic in terms of its speed, magnitude, and coordination across countries and between fiscal and monetary. But this chart perhaps highlights one limitation of monetary policy, the tag line is “interest rates are low, but good luck getting a loan” (given how much banks tightened up on lending standards). One thing on my mind is a possible passing of the torch from monetary policy to fiscal policy – as that’s going to be the thing that will achieve a more balanced and more transformative impact in the recovery.”

3. Global Trade Rebound: Global trade has made a rapid recovery, with global trade volumes easily clearing pre-pandemic levels. The snapback has been so rapid (recovering demand, changing demand) in fact that shipping costs have surged – e.g. as an interesting anecdote, the price of humble wooden shipping pallets has doubled.

“The global economic shutdown saw an abrupt collapse in trade growth. But since then we have seen clear green shoots and the leading indicators point to an acceleration and continuation of the global trade growth rebound into 2021.”

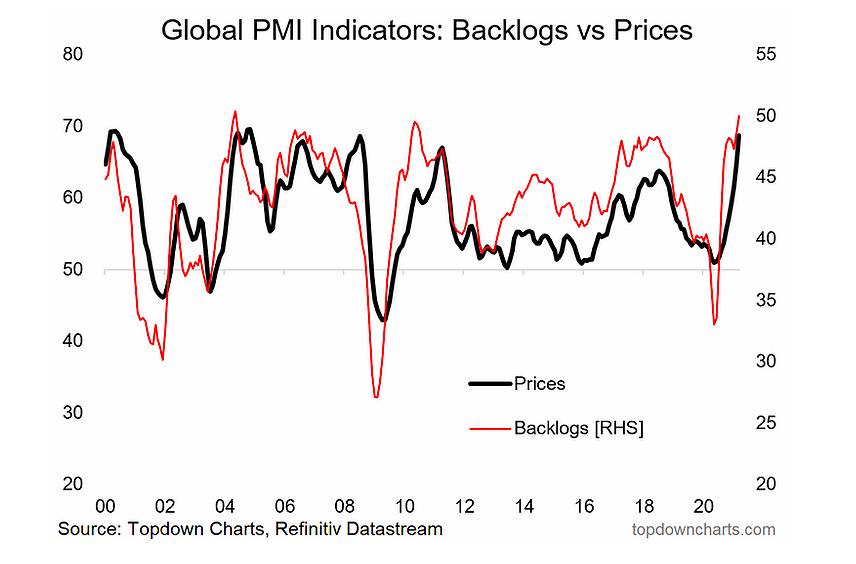

4. Global Backlogs: As such, it should be no surprise to see that the backlogs/supply chain disruption issue has only gotten worse… and boats getting stuck in canals don’t exactly help the situation! As a result of tight inventories, lengthy shipping delays, shortages of parts, logistics challenges, lockdowns, and surging freight rates, we have started to see wider pricing pressure come through. Thus inflation risks remain very much upward skewed in the near-term [but as noted in my Q2 Strategy Pack, medium-term the case for higher inflation is also compelling].

“A nice follow-on, the surge in backlogs (resulting from global supply chain disruption) has 2 key implications: upside risk to inflation, and a likely spike in activity as firms attempt to clear backlogs and restock inventories.”

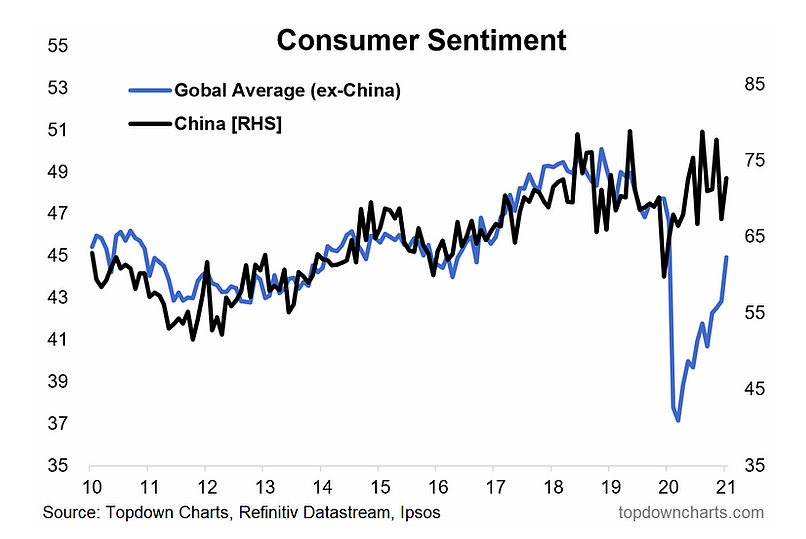

5. Consumer Normalization: Consumer sentiment is steadily recovering worldwide as vaccines are rolled out (worldwide vaccinations are running at a pace of 17m/day at the time of writing), asset prices steadily push higher (housing + equities), and at least according to the stats: *in aggregate* consumers are flush with cash.

“Consumer moods remain depressed *outside of China*. This chart provides a sort of playbook for the rest of the world, as well as a key means of keeping track of normalization, and a nod to a potential consumer boom post-vaccine.”

5 more charts to go… be sure to click through to the next page to see those.

CONTINUE READING ON THE NEXT PAGE…