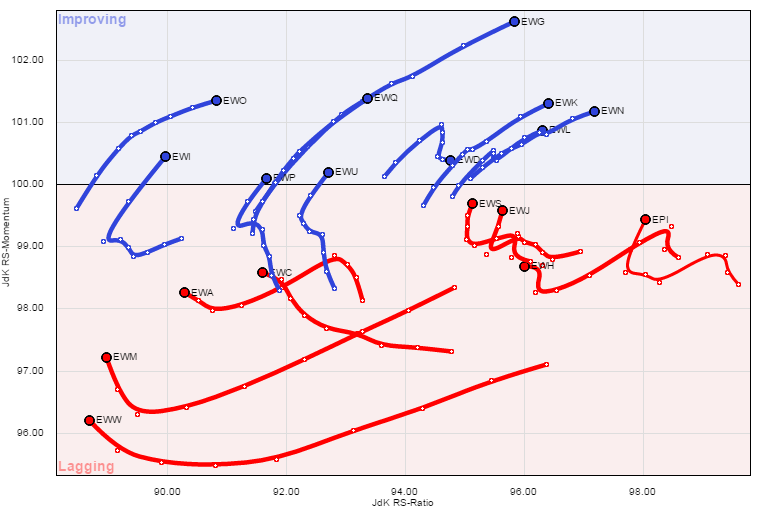

With the start of 2015 we have begun to see movement in international markets after the focus has been squarely on U.S. equities over the last two years. After the first few weeks of January, international markets have put in a stint of outperformance relative to U.S. indices. When this begins to happen I like to find some of the stronger markets among the international group. To do this we can use the Relative Rotation Graph (RRG) which measures the relative performance of a set of ticker symbols relative to the S&P 500 (SPY) while also measuring the momentum of that relative performance.

Below is the RRG chart which includes most of the major international markets. What stands out on this chart is the iShares Germany ETF (EWG). It began to improve its momentum of relative performance, which often leads actual relative performance by increasing vertically. Further, over the past several weeks it has began to move to the right as its relative performance has strengthened.

Relative Rotation Graph

Next up we have the price action of the iShares Germany ETF (EWG) over the last year – see chart below. While this ETF has been in a down trend for the last year, it’s begun to improve as it puts in a possible higher low to start off 2015. With the rally over the last couple of weeks EWG has also been ab le to break above its falling short-term trend line. While at the same time the Relative Strength Index (RSI), a momentum indicator, has already gotten back above its prior high set in December. We are also seeing a bullish crossover for the MACD indicator as well. These are positive signs that momentum is beginning to shift to favor higher prices in EWG. Going forward I’m watching to see if EWG can get back to its 200-day Moving Average and continue higher to its 2014 high. If things do not continue to improve we could see EWG test its prior October low.

Germany ETF (EWG) Chart

The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.

Follow Andrew on Twitter: @AndrewThrasher

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.