Buy the dippers have been a roadblock to shorts’ success.

It is probably not an exaggeration to say that the prevailing buy the dip mentality in U.S. equities has done to this bull market what oxygen does to a fire. When O is present, any fire that starts will burn hotter and faster than usual.

It has been nearly three years since the S&P 500 large cap index suffered a 10-percent correction. It came close in September-October last year, but fell short by a whisker.

The point is, investors have been conditioned to buy the dips, and it has worked. Central-banks’ dogged desire to benefit from the wealth effect has helped provide a backstop. When we add to the mix persistently high short interest, it has been a powerful combo.

For shorts, there is no shortage of things to fixate on. The economy is sluggish. Earnings growth is in deceleration. Valuations are no longer cheap. Despite all the deleveraging talk, the debt load is higher than during 2007-2008. Wage growth is stagnant. Companies are more interested in share buybacks/dividend payments than in capital expenditures. And on and on. From a longer-term perspective, none of this bodes well.

Viewed from this context, one would expect a rise in short interest. Nonetheless, shorts are also fighting the Fed – and other central banks – and more often than not have been on the losing end of the battle. There will come a time when they will end up winning the war. Whenever that is. Central-bank activism has only dug deep the debt hole that is at the root of the problem.

Until then, buildup in short interest potentially = shallow pullbacks in stocks.

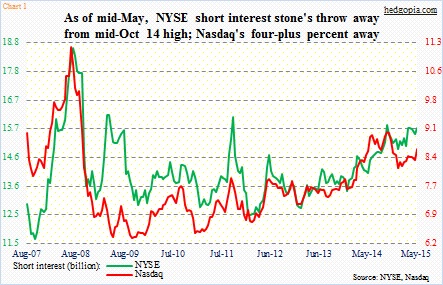

By mid-October last year, when stocks bottomed, short interest on the NYSE composite stood at 15.8 billion and at nine billion on the Nasdaq composite (see chart above). By year-end, this had decreased to 14.9 billion and 8.1 billion respectively. During the period, the indices respectively rallied seven and 12 percent. Shorts covered and/or got squeezed.

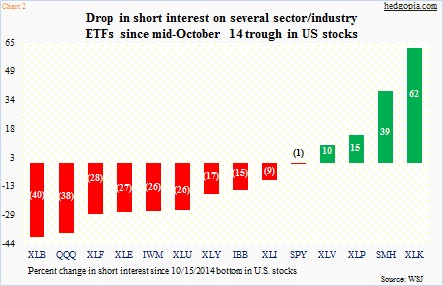

Since end-December through mid-May, the indices rallied more – another three and six percent, in that order. Shorts have been adding, but with less aggression than in days leading up to the mid-October bottom in stocks. This is also evident in several ETFs (see chart below).

On the NYSE Composite Index, short interest is less than a percent away from the mid-October high, while on the Nasdaq it is five percent off that high. At first glance, shorts seem hesitant. But on both these indices short interest remains higher than in October 2007 when equities peaked.

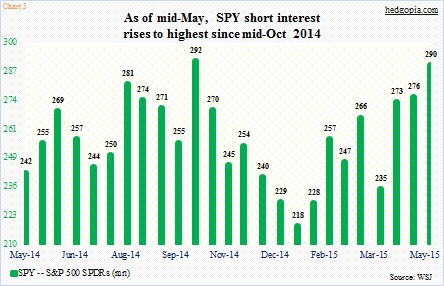

For bulls, this is as good an opportunity as any to try to force a squeeze. In the most recent reporting period (mid-May), short interest rose 1.5 percent on the NYSE and 3.5 percent on the Nasdaq. Short interest on the S&P 500 SPDR ETF (SPY), rose five-plus percent, to the highest since mid-October (see chart below). On the Technology SPDR ETF (XLK), it is the highest in at least a year. On the Consumer Discretionary SPDR ETF (XLY), it is the highest since mid-October.

The inability on the part of bulls to force a squeeze could embolden the shorts. Going back to October 2007, as buy the dip crowd went to the sidelines, NYSE short interest rose from 11.7 billion to 15.6 billion in six months, and on the Nasdaq from eight billion to 9.6 billion during the period. Stocks tumbled.

That is the scenario shorts have been pining for. A home run – not the singles and doubles they are having to put up with for a while now. If only the buy the dippers would let them.

Thanks for reading!

Twitter: @hedgopia

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.