The US equity markets retreated last week from record levels, with the S&P 500 Index falling 1.2 percent.

The pause is likely due to investors weighing a possible Federal Reserve interest rate cut versus lower second-quarter earnings expectations, as well as an apparent stall in U.S./China trade negotiations.

The next meeting of the Federal Reserve will conclude on July 31 and is expected to result in a 25-basis point rate cut with the outside chance of a 50% reduction. The later seems unlikely given that Fed officials have stated that recent economic developments have not indicated an impending slowdown.

Federal Reserve Chairman Jerome Powell’s testimony before Congress ten days ago indicated more concern about global growth rather than economic problems in the U.S. economy. Second-quarter earnings season began last week with mixed results.

Some companies have exceeded the low expectations but the outlook for the overall S&P 500 index is that earnings will still be slightly negative from a year earlier.

Trade talks with China appear to have stalled and the threat of more tariffs loom. A trade agreement will likely be a long process, and China may be willing to ‘wait it out’ with the idea that continued trade uncertainty may have a negative impact on the U.S. economy. This uncertainty has indeed prompted weakness in business capital spending.

The good news is that many U.S. companies have been moving their manufacturing out of China and finding cheaper labor in places like Viet Nam, Bangladesh, Thailand and India.

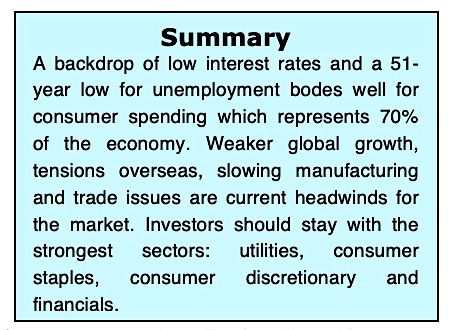

A backdrop of low interest rates, unemployment at a 51-year low and a solid economy encourage consumer spending, which represents 70% of the economy.

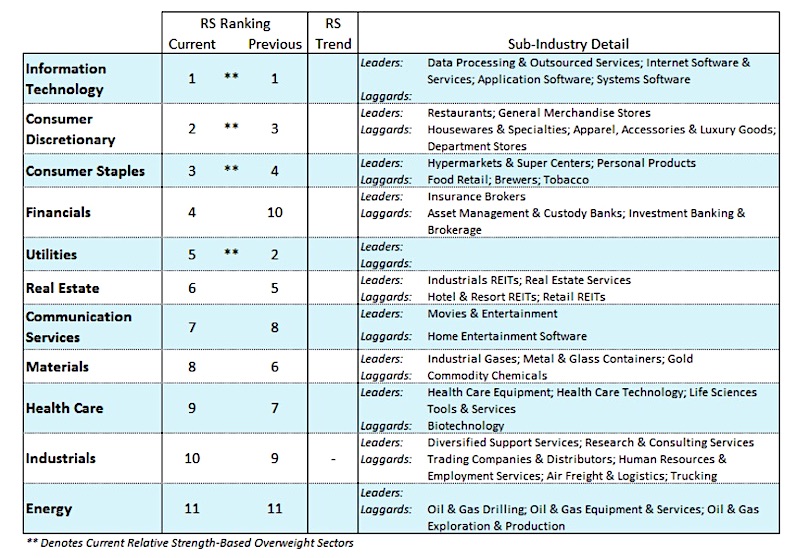

While this is fundamentally a positive backdrop for the stock market, with weak global growth, trade issues, overseas tensions, slowing U.S. manufacturing, and a stock market at its all-time high, we suggest investors stay with the strongest sectors of the market which are utilities, consumer staples, consumer discretionary and financials. It is a good time to assess risk tolerance ahead of the likely bouts of volatility.

We do not believe it is too late to buy good quality corporate bonds and gold to balance a portfolio. Low interest rates and uncertainties over the U.S. and China trade war as well as the current geopolitical tensions create an attractive opportunity to invest in gold.

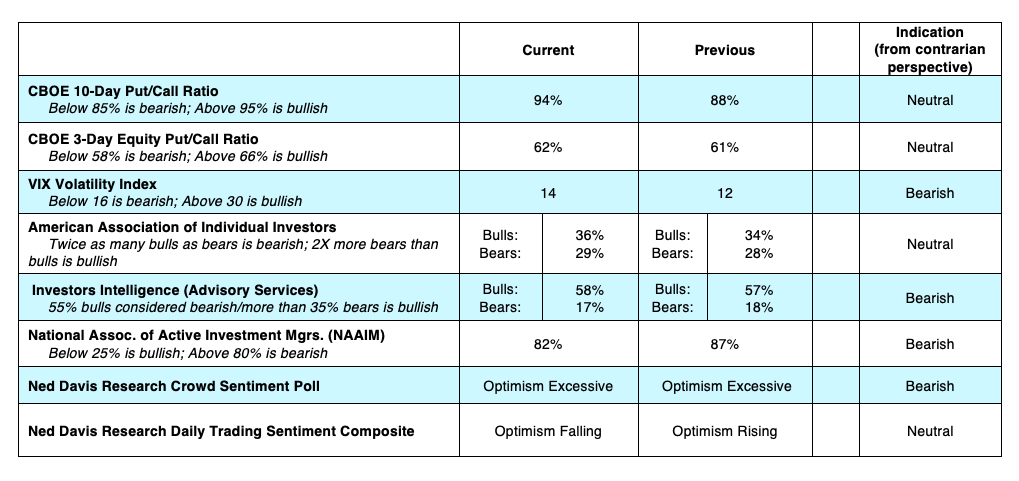

The technical picture is mixed with a modest improvement in stock market breadth but with growing investor optimism which is a worry to contrarians. While there remains a healthy percentage of S&P 500 stocks trading above their 50- and 200-day moving averages, small- and mid-caps continue to significantly underperform leaving market breadth overall only mildly bullish. The Russell 2000 small-cap index is virtually unchanged since February and substantially below its 2018 peak.

Investor sentiment is moving toward excessive levels as seen in the latest report from Investors Intelligence (II) which now shows 58% bulls. A move above 60% bulls among Wall Street letter writers has been a reliable figure signaling the approach of a short-term peak in stock prices. The bears in the II service fell to just 16.6% last week. Few bears mean higher risk from a contrarian’s viewpoint.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.