This week I wanted to preview what I believe to be the most important storyline to track for Corn and Soybean Bulls as we inch closer to “spring” and the start of the 2019 U.S. corn growing season.

March Prospective Plantings Report (release date: 3/29/2019).

I’ve been referencing this price driver for several weeks that being the significance of this year’s corn and soybean planted acreage balance.

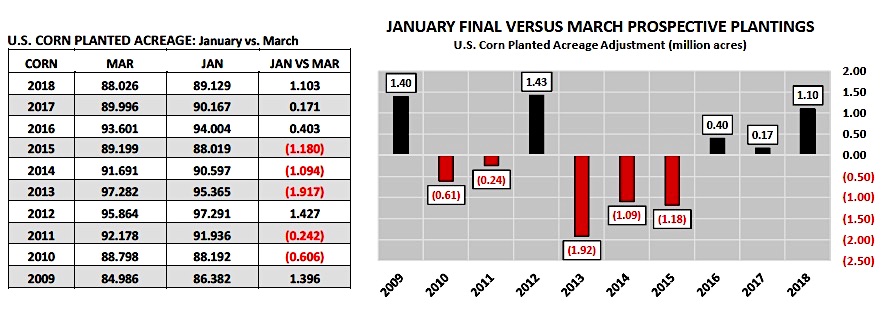

At the end of the month the market will receive the USDA’s Prospective Plantings report. In 2018 the USDA estimated U.S. corn planted acreage at 88.03 million acres in March. By January that planted acreage figure had been revised upward by 1.10 million acres (+1.3%). In soybeans the USDA’s March prospective plantings forecast was 88.98 million acres versus final planted acreage in January of 89.20 million acres (+0.2%).

Over the past 10-years the USDA has increased planted corn acreage 5 times from March to January an average of +0.90 million acres versus 5 decreases averaging -1.01 million acres (see below).

In soybeans the USDA has increased planted soybeans acreage 6 times from March to January an average of +1.44 million acres versus 4 decreases averaging -1.13 million acres (see page 2). Suffice it to say, there seems to be no definitive planted acreage trend higher or lower in either corn or soybeans from March to January. And furthermore in corn specifically the average percentage change from March to January has only been approximately 1% over the last 10-years (up or down) suggesting the USDA’s March prospective plantings forecast has historically been incredibly accurate.

At the February Ag Outlook Forum the USDA estimated 2019/20 U.S. corn planted acreage at 92.0 million acres, up 2.9 million acres from 2018. And just this week Informa Economics released their U.S. corn planted acreage estimate of 91.8 million acres; therefore slightly below the USDA.

In soybeans the USDA’s Ag Outlook Forum estimate was 85.0 million acres, down 4.2 million acres from 2018 with Informa issuing a forecast of 85.5 million acres. In my opinion the spotlight moving forward will primarily be on the USDA’s prospective plantings estimate for corn…why?

Of the two crops, corn and soybeans, the U.S. corn balance clearly remains the most sensitive to an unexpected acreage adjustment, considering soybeans have a massive supply cushion in 2019/20 via record carryin stocks of 900 million bushels.

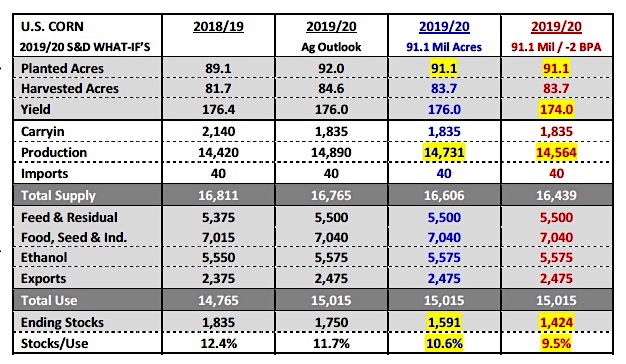

That said in corn, with U.S. carryin stocks currently projected at 1.835 billion bushels (305 million bushels below last year) and 2019/20 U.S. corn demand estimated at a record high 15.015 billion bushels (Ag Outlook Forum), the difference between 92 million planted U.S. corn acres in 2019 and 91.1 million acres (1% decline) is not insignificant as it relates to the impact on 2019/20 U.S. corn ending stocks.

For example if U.S. corn acreage were to drop to 91.1 million planted acres, and everything else were to remain static relative to the USDA’s Ag Outlook S&D estimates including incorporating a trend-line yield of 176 bpa and total usage of 15.015 billion bushels, 2019/20 U.S. corn ending stocks would fall to 1.591 billion bushels (stocks-to-use ratio of 10.6%).

If we took it a step further and also reduced the U.S. corn yield 2 bpa to 174 bpa, U.S. corn ending stocks would dip to 1.424 billion bushels (stocks-to-use ratio of 9.5%). The last time the U.S. had a stocks-to-use ratio in corn under 10% was in 2013/14. During the calendar years of 2013 and 2014, December corn futures traded up to and above $4.50 per bushel on several occasions.

Does this mean I’m automatically endorsing rallies up to $4.50 in December corn futures this summer? Absolutely not…

However, what I will stand by is the belief that if the USDA’s prospective plantings forecast for corn comes in under 91.5 million acres on March 29th, traders will immediately start to hyper-analyze 2019/20 U.S. corn yield prospects.

continue reading on the next page…