It was a big week for stock market bulls, as the S&P 500 Index jumped 2.3% in the last full week of trading in May. Was that the last hurrah for the bulls? Will “Sell in May” work this year?

With the June Fed meeting on tap and the Brexit vote coming up, things could get interesting. But until we actually see a decisive breakout (or breakdown) in the price action, we’ll just have to build our individual cases for stocks and the market.

It’s an interesting time to be trading and investing in the markets. Current monetary policy and this years’ presidential election should be enough to convince you of that. The election hoopla has been pretty crazy, as both Trump and Clinton come with plenty of “noise”. The coming weeks may require seat belts (in either market direction).

We cannot take anything for granted. This week’s “Top Trading Links” offers some spectacular holiday reading. Dig in!

MARKET INSIGHTS

Wave Theory suggests U.S. stocks are in wave 4 – John Murphy

The conditions you’d want are already here – Josh Brown

Option Traders continue their unusual hedging – Dana Lyons

The Volatility market is showing signs of complacency – Andrew Thrasher

Investing in a president Trump America – Fly

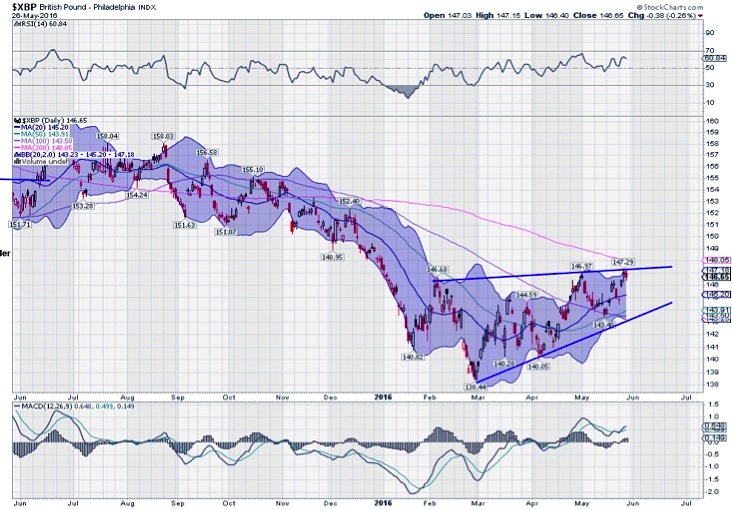

The Pound Sterling is shining into the Brexit vote – Greg Harmon

Howard Marks’ latest memo: Economic Reality

U.S. GDP growth is expected to rebound in Q2 – The Capital Spectator

Is it time to start buying dips in the U.S. Dollar Index? – James Bartelloni

NEWS & RESEARCH

Slowing the aging process might be easier than curing cancer – Jon Markman

A computerized trading firm has overtaken Deutsche Bank in European currency trading market share – Bloomberg

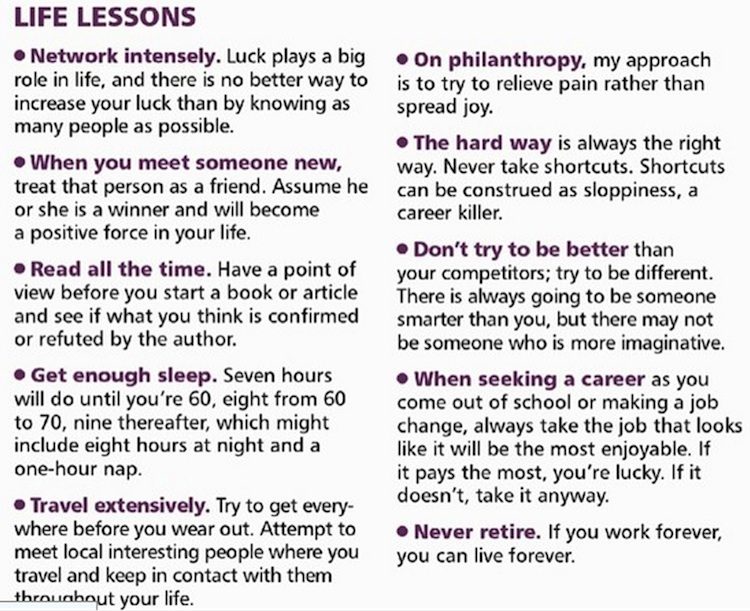

Byron Wien’s life lessons:

Amazon Shoppers seek products, not brands – L2 Inc

The advantage of being overconfident and self deluded – Psyblog

Eager to be wrong – Farnham Street

Why U.S. Nukes controlled by ancient computers are actually a good thing – Paul Szoldra

Thanks for reading. Be sure to check back next weekend for another round of “Top Trading Links”.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.