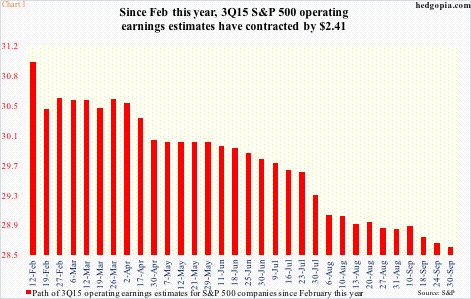

Third-quarter corporate earnings season begins in earnest this week. Operating earnings estimates for S&P 500 companies have been persistently coming down for 2015 – from as high as $137.52 at the end of the second quarter last year to $110.98 as of September 30th!

Quarterly estimates obviously are on the same trajectory. During the same period, estimates for the third quarter have gone from $34.86 to $28.61 (Chart 1 only goes back to February this year.)

If 3Q estimates are met, earnings would still be down 3.3 percent from last year’s $29.60. For the year, earnings are slated to drop 1.8 percent.

The revision trend is clearly down. Stocks are beginning to reflect this. As is sentiment.

Operating Earnings Estimates Contracting

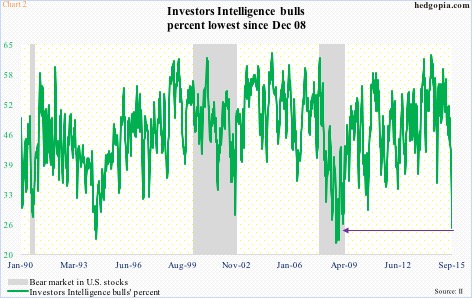

Last week, the percentage of bulls in Investors Intelligence’s weekly survey dropped to 24.7 – the lowest sentiment reading since 23.1 in December 2008 (Chart 2 below). Bears, too, jumped 4.9 points to 35.1, but their ranks have not risen enough, as they have in the past, to indicate an important bottom in stocks. The reason is likely due to those in the correction camp, a separate sentiment poll that has been stuck in the 40s for the last nine weeks. Bulls, on the other hand, have just about given up.

Investors Intelligence Bulls Very Low Reading

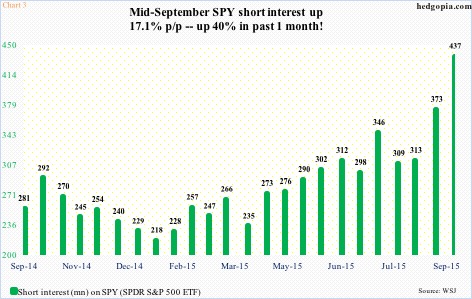

A similar rapid shift in sentiment is also reflected in the short interest data. We don’t yet have end-September numbers (they will be published this Friday), but as of the middle of September short interest on the SPDR S&P 500 ETF (SPY) stood at a massive 437 million, and has gone up 40 percent in just one month (Chart 3 below). The picture is the same elsewhere. Short interest on the PowerShares Nasdaq 100 ETF (QQQ) has gone up 84 percent in the past month and a half, and on the iShares Russell 2000 ETF (IWM) 19 percent in the past couple of months (QQQ and IWM not shown here).

SPY Short Interest Chart

As far as the S&P 500 is concerned, there is a similar message coming out of the futures market.

continue reading on the next page…