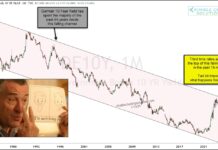

S&P 500 futures trading chart – June 26

Profit taking continues in a discordant stock market.

Take a look at this list of market highs.

Gold is retracing and could easily get to 1364 in a stairstep fade to 1406 and then 1387 before hitting the target. I suspect jumping into longs with shallow dips might not be ideal.

The crosscurrents are heavy here still.

The US dollar is creating a bottoming formation for now with the participating traders. I like using the 4hr formation to direct me as it is slower and I can process more information to make a decision. If you prefer a shorter time frame, just make sure that you are moving to process the information required to make the most probabilistically solid decision.

THE BIG PICTURE – Daily momentum is positive to neutral and somewhat range bound from a larger intraday time frames- holding above 2946 (broken twice and recovered once) in the $ES_F sends us back into breakout territory and keeps buyers brave. Below this level, we’ll need to be a bit more cautious about bullish exposure and allows sellers to grasp a foothold – this is our current condition.

INTRADAY RECAP – Selling ES near the 2947.5 with stops a bit wider- or buying near 2923 – again with wider stops. If we have trouble with 2937, in either direction, it is time to leave the trade. We are in a wide angle rangebound region. Holding 2917 becomes a critical zone – else we give back all the gains from the Fed announcement. Traders are a bit nervous about the mad run in gold while the markets hold steady. It is making them nervous.

Sellers want to move us below 2917 intraday. Pullbacks into higher lows will be buy zones intraday and traders have a mildly bullish to neutral slant overall.

NEUTRAL SLANT – Manage your risk by waiting to the edges and playing the range with a slight bearish slant intraday. The backdrop of global slowdown and trade chatter still prevails – the G20 meeting is in view in Osaka.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.