The iShares 20+ Year Treasury Bond Fund (TLT) declined 16 percent between the all-time intra-day high of 137.09 on January 30 and the low of 115.26 last Wednesday. And this could breathe life into an options trading idea. But before we look into that, let’s review the broader bond market.

It is as if the bond market globally has been awakened from its slumber. Interest rates of late have been under pressure everywhere. German 10-year yields rose from 0.05 percent less than two months ago to north of one percent last week.

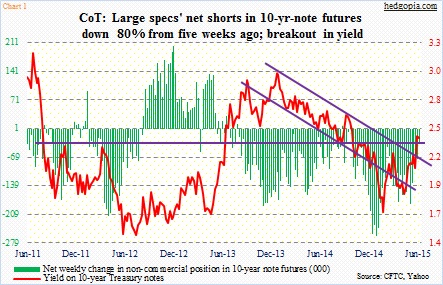

From this perspective, the 65-basis-point rise in the 10-year Treasury yield (TNX) in the past two months looks orderly. At the same time, yields have risen 85 basis points in a little over four months. It is the speed – or the rate of change – that matters. In the process, the 10-year has broken out of a descending channel (Chart 1).

Right now, one can think of plenty of reasons not to like TLT. Monthly momentum indicators are under pressure, with a possible bearish MACD crossover in the making. The ETF just lost three-year support at 118. On a daily chart, a death cross looms large. The 50-day moving average (123.47) is rapidly approaching the 200-day (122.84) from above. Either way, it is oversold near-term – which could play a role in options trading.

This week, the FOMC meets. Since the last meeting six weeks ago, the IMF and the World Bank have openly urged the Federal Reserve not to go ahead with a rate hike until next year. The bond market is jittery.

The Fed’s action has the potential to have repercussions globally, particularly considering $9 trillion sit in dollar-denominated, non-bank debt outside the U.S. In due course, this debt load needs to be repaid or rolled over. Higher interest rates only hurt. This is one side of the coin.

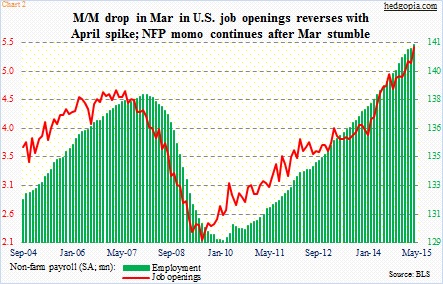

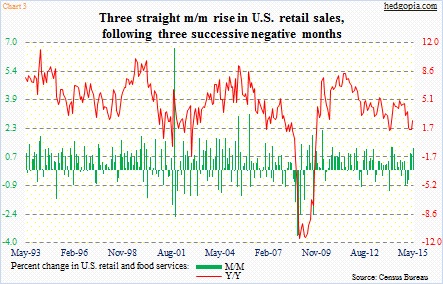

Another side is what is going on in the economy at home. May’s jobs report – nonfarm payroll up 280,000 – shook off March weakness. Non-farm job openings – 5.4 million – made a new high in April (Chart 2). Retail sales have now been up in the last three months, following three consecutive down months before that. The Atlanta Fed’s GDPNow model is now forecasting second-quarter real GDP growth of 1.9 percent (as of June 11), up from 1.1 percent (as of June 3). Recall that output shrank 0.7 percent in the first quarter.

So come Wednesday it is possible the Fed ignores the IMF/World Bank pleas and sounds a bit more hawkish than they did last time. In this scenario, TLT may sell off again. Well, maybe, maybe not. And that’s where it gets tricky in options trading – because expectations play a big role (especially short-term).

Given the backup in yields recently, the bond market probably expects a hawkish message anyway. If the ETF sells off, traders likely will use this as an opportunity to go long at least near-term. In the event that the FOMC message is not as hawkish as expected – perceived or real – it is a no-brainer. Given the pressure it has come under lately, TLT likely gets bid up, or at least not make a new low.

Looking at Chart 1, large speculators have indeed been reducing net shorts in 10-year note futures, to a nearly-eight-month low of 36,579 contracts. Merely five weeks ago, they were net short 183,116 contracts.

Near-term, we may very well be looking at a ‘heads I win, tails you lose’ scenario.

Technically, TLT produced another dragonfly doji last week. In the past five weeks, there have been three. As well, the ETF last week bounced off of the lower end of a descending channel it has carved out for itself. In the right circumstances, there is room for it to move up. Of course, there are hurdles – 118 and change, and then the 200-day moving average.

Given these dynamics, TLT looks set up well for a cash-secured put (note Friday’s closing price of 117.95).

June (expires this week) 117.5 puts are selling for $0.90. If put, it ensures an effective long at 116.60. Otherwise, we keep the premium.

Thanks for reading!

Twitter: @hedgopia

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.