As an active, but long term investor I believe identifying long term investment themes is a key element to success. One long term trend that may not be good for our country, but may offer opportunity, is the current upward trajectory in obesity trends.

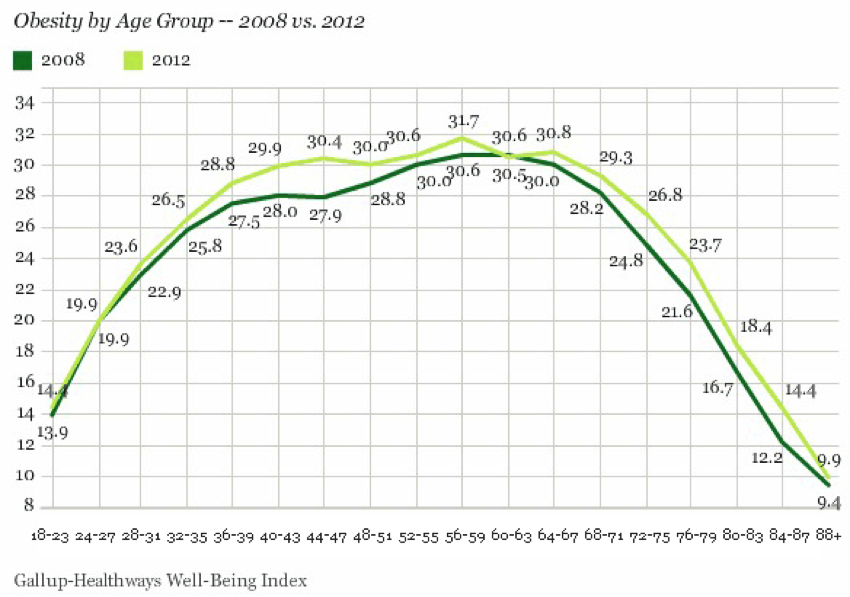

A recent report by the Trust for Americas Health and the Robert Wood Johnson Foundation forecasts obesity related diseases and financial costs for the US and it’s not pretty. Since 1980 the US adult obesity rate has doubled and rates for children have tripled, so it is probably a pretty safe bet that this trend will not change overnight. The report states that approximately 36% of adults are obese today and that could grow to 44% by 2030 if the current obesity trends continue. Just as importantly, obesity related medical costs are forecast to rise by $48 billion dollars to $66 billion a year over the same time period. And lastly, the report estimates that all this additional weight could result in lost economic productivity valuing $390 to $580 billion per year.

While the US still claims the prize as the fattest nation, others are beginning to provide competition with Mexico, UK and Greece all in the top 5. And as other emerging market economies such as China, Brazil and India continue to grow their per capita GDP, it wouldn’t be too far off to expect that they will also indulge in much the same way we do at home… and likely with a similar result.

So, as the world´s waistlines continue to grow, how can we take advantage of the theme to ensure our portfolios keeps pace? Well, one way to start is identifying the most common diseases and health problems associated with obesity along with the companies that benefit from them. According to the CDC (Center for Disease Control and Prevention), type 2 diabetes is the seventh leading cause of death and racks up $174 billion in total health care costs. The number of Americans with the disease has grown from 7.8 million to 25.8 million in the past 20 years and that growth is expected to continue. Heart disease and stroke are the first and fourth leading causes of death in the US, most resulting from obesity and hypertension according the CDC.

If costs associated with obesity are expected to climb, what companies are best positioned to benefit? Drug companies such as Pfizer (PFE) that sells Lipitor for high cholesterol and Bristol–Myers Squibb´s (BMY) Plavix for heart attack and stroke prevention are two that historically have done well. On the prevention side of the equation companies like Weight Watchers (WTW), Vitamin Shoppe (VSI), United Natural Foods (UNFI) and Whole Foods (WFM) may benefit from increased consumer awareness and a desire to eat healthier and have a more active lifestyle. In the leisure space, gyms, spas and resorts focused on wellness, nutrition and fitness could be beneficiaries. One thing is certain, current obesity trends are flashing caution signs and as this becomes a larger and larger health risk, the money spent to control or prevent it will grow as well.

I currently have no positions in any of the companies mentioned.

Sources: 1) Center for Disease Control www.CDC.gov; 2) “F as in Fat: How Obesity Threatens America´s Future by Trust for America´s Health” and the Robert Wood Johnson Foundation; 3) US Trust October 2012 Capital Markets Report

—————————————————————-

Twitter: @JoshuaSchroede2 and @seeitmarket Facebook: See It Market

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.