Nike (NKE) fell 6% on Friday, after the footwear maker posted earnings that beat Wall Street expectations but included disappointing guidance.

Furthermore, the stock’s market cycles suggest there is still more downside risk into the coming months.

The company reported earnings per share of $0.68 and total revenue of $9.61 billion, compared to analyst estimates of $0.64 and $9.58 billion.

However, CFO Andrew Campion explained that while he expects strong sales for the coming quarter, “We expect 6 points of foreign exchange headwinds, which would result in low single digit reported revenue growth.”

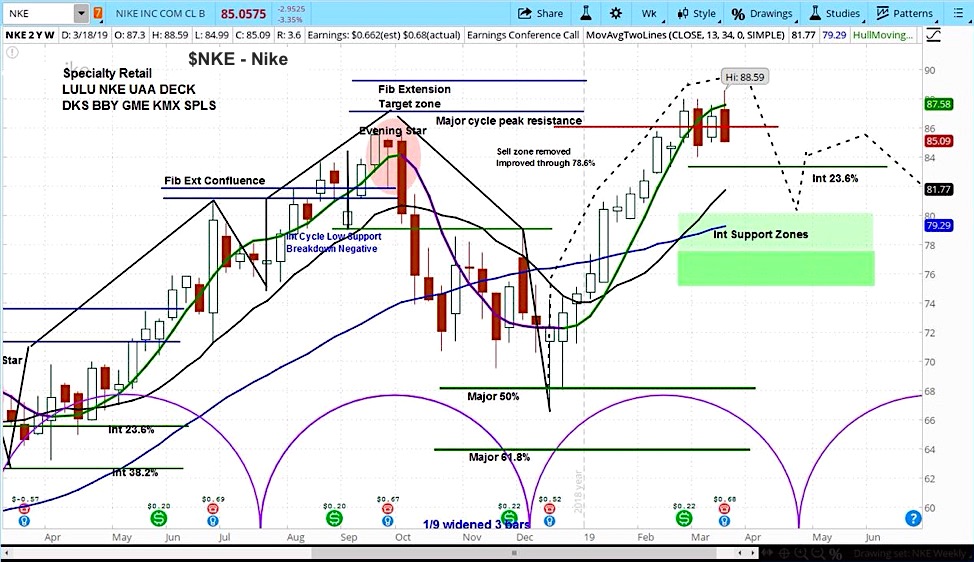

In analyzing the market cycles for NKE, we can see that the stock is now in its declining phase as its approaches the end of its current cycle.

In fact, we believe it has clearly topped, with a likely decline into May. Our target is $80-83.

Nike (NKE) Stock Weekly Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.