“The journey of a thousand miles begins with one step.” – Lao Tzu

In a tiny first step on December 16, 2015, the Federal Reserve (Fed) did something they had not done in over nine years. From the unprecedented starting point of zero, they raised the Fed Funds rate.

Since, they have begun to allow their swollen balance sheet to contract in what can only be characterized as another unprecedented event. Although monetary policy remains extreme and real rates only recently have turned positive, these measures mark the end of an era of maintainingextreme financial crisis monetary policy in the United States.

Reversing these experimental policies initiates a new set of dynamics which will gradually reduce excessive liquidity from the financial system. Just as quantitative easing (QE) and zero interest rates were a grand experiment, the removal of these policy measures is equally experimental. Now, over 325 million domestic lab rats and the rest of the world wait to see how it plays out. Importantly, if the Fed continues down this path, investors should carefully consider potential risks and the appropriate market exposure in this brave new world.

Despite the multitude of unanswerable questions about the implications of these events, what we know is that the economy is in the late stages of an economic expansion.

Just as low tides follow high tides, we can use prior cycles as a guide to consider prudent, late-stage portfolio positioning.

Market Expectations

As discussed in, Everyone Hears the Fed but Few Listen, the difference between Fed officials’ expected path of Fed rate hikes and market expectations for the Fed Funds rate is important. The implications for the market and investors are especially compelling when considering asset allocation weightings. For example, if the Fed continues on their path of more rate hikes and surpasses market expectations, stocks are likely to struggle as much needed liquidity evaporates. The bond market, on the other hand, will probably continue to do what it has been doing, but to a greater extent. A flatter and possibly an inverted yield curve would be in order unless inflation rises by more than is currently expected. Conversely, if the Fed backs away from their current commitment, it will likely be bullish for risk assets and the yield curve would probably steepen, led by a decline in 2-year Treasury yields.

Context

Through September this year, the U.S. economy has posted an average growth rate of 3.3% (average quarterly annualized) and S&P 500 earnings have grown over 20% so far this year. The news from consumer and business surveys is favorable, and the country is essentially at full employment. That all sounds good, but is it sustainable?

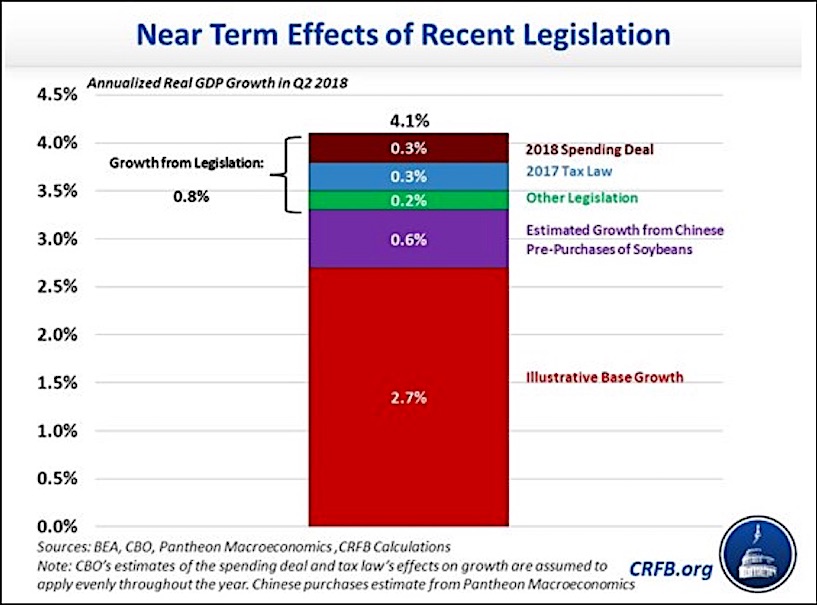

The table below, courtesy of the Committee for a Responsible Fiscal Budget (CRFB), shows that recent tax and budget legislation along with soybean purchases in anticipation of trade tariffs drove recent economic growth at the margin.

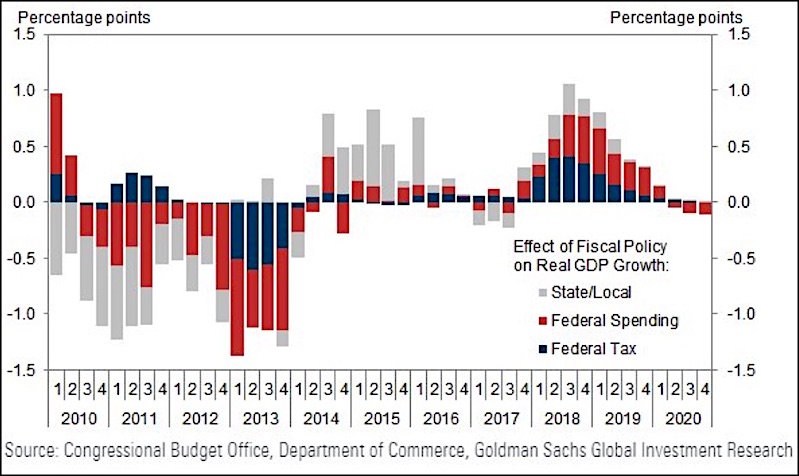

While the stimulative impact of fiscal policy remains favorable, it will steadily decline toward neutral for the rest of this year and throughout 2019. Policies regarding tariffs and trade are likely to weigh on economic growth throughout this year and next year. Most importantly, the Fed is clear that their plans are to continuing raising rates and reducing the holdings on their balance sheet that resulted from QE.

Late-Cycle Adjustments

Since the end of the recession in June 2009, the economy has clearly moved from recovery to expansion. That means the U.S. economy is nearing the “slowdown” phase of the cycle and heading toward the contraction (recession) phase. The evidence of the U.S. now being in a late-cycle environment is compelling and strongly suggests that investors modify their asset allocation weightings to protect against losses as the cycle progresses.

The Path Forward

The past does not provide investors with perfect information about how we should invest, but it does offer excellent clues. It may be helpful to look at the major asset classes and consider portfolio adjustments for late-cycle positioning.

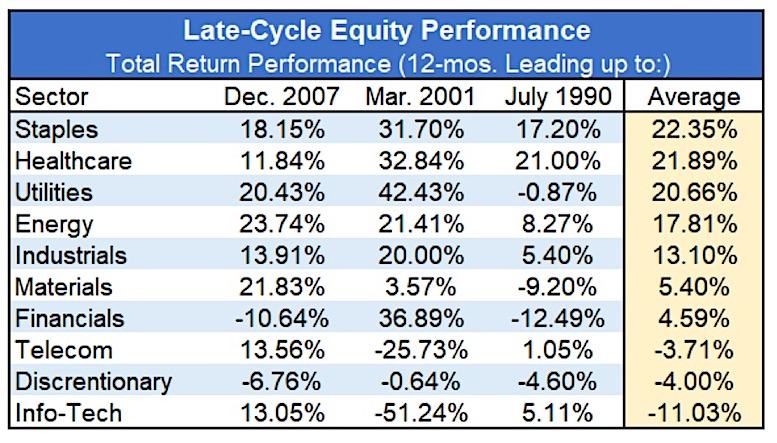

U.S. Stocks:To evaluate late-cycle performance, we looked at equity performance by sector in the 12-months leading up to each of the prior three recessions (1990, 2001, and 2007).

Data Courtesy Bloomberg

Every environment is different, and what outperformed in the past may not on this occasion as the cycle unfolds. Prior to the last three recessions, investors preferred defensive sectors, such as staples, healthcare, utilities, energy and industrials during late-cycle periods.

Now let’s take a look at bonds performance during late cycles.

continue reading on the next page…