President Trump recently nominated Judy Shelton to fill an open seat on the Federal Reserve Board. She was recently quoted by the Washington Post as follows:

“(I) would lower rates as fast, as efficiently, and as expeditiously as possible.” From a political perspective there is no doubting that Shelton is conservative.

Janet Yellen, a Ph.D. economist from Brooklyn, New York, appointed by President Barack Obama, was the most liberal Fed Chairman in the last thirty years.

Despite what appears to be polar opposite political views, Mrs. Shelton and Mrs. Yellen have nearly identical approaches regarding their philosophy in prescribing monetary policy.

Simply put, they are uber-liberal when it comes to monetary policy, making them consistent with past chairmen such as Ben Bernanke and Alan Greenspan and current chairman Jay Powell.

Part one of this article can be found HERE.

In fact, it was Fed Chairman Paul Volcker (1979 to 1987), a Democrat appointed by President Jimmy Carter, who last demonstrated a conservative approach towards monetary policy. During his term, Volcker defied presidential “advice” on multiple occasions and raised interest rates aggressively to choke off inflation. In the short-term, he harmed the markets and cooled economic activity. In the long run, his actions arrested double-digit inflation that was crippling the nation and laid the foundation for a 20-year economic expansion.

Today, there are no conservative monetary policy makers at the Fed. Since Volcker, the Fed has been run by self-described liberals and conservatives preaching easy money from the same pulpit. Their extraordinary policies of the last 20 years are based almost entirely on creating more debt to support the debt of yesteryear as well as economic and market activity today. These economic leaders show little to no regard for tomorrow and the consequences that arise from their policies. They are clearly focused on political expediency.

Different Roads but the Same Path –Government

Bernie Sanders, Alexandria Ocasio-Cortez, Elizabeth Warren, and a host of others from the left-wing of the Democrat party are pushing for more social spending. To support their platform they promote an economic policy called Modern Monetary Theory (MMT). Read HERE and HERE for our thoughts on MMT.

In general, MMT would authorize the Fed to print money to support government spending with the intention of boosting economic activity. The idealized outcome of this scheme is greater prosperity for all U.S. citizens. The critical part of MMT is that it would enable the government to spend well beyond tax revenue yet not owe a dime.

President Trump blamed the Fed for employing conservative monetary policy and limiting economic growth when he opined, “Frankly, if we didn’t have somebody that would raise interest rates and do quantitative tightening (Powell), we would have been at over 4 instead of a 3.1.”

Since President Trump took office, U.S government debt has risen by approximately $1 trillion per year. The remainder of the post-financial crisis period saw increases in U.S. government debt outstanding of less than half that amount. Despite what appears to be polar opposite views on just about everything, under both Republican and Democratic leadership, Congress has not done anything to slow spending or even consider the unsustainable fiscal path we are on. The last time the government ran such exorbitant deficits while the economy was at full employment and growing was during the Lyndon B. Johnson administration. The inflationary mess it created were those that Fed Chairman Volcker was charged with cleaning up.

From the top down, the U.S. government is and has been stacked with fiscal policymakers who, despite their political leanings, are far too undisciplined on the fiscal front.

We frequently assume that a candidate of a certain political party has views corresponding with those traditionally associated with their party. However, in the realm of fiscal and monetary policy, any such distinctions have long since been abandoned.

TRUST

Now consider the current stance of Democratic and Republican fiscal and monetary policy within the TRUST framework. Government leaders are pushing for unprecedented doses of economic stimulus. Their secondary goal is to maximize growth via debt-driven spending. Such policies are fully supported by the Fed who keeps interest rates well below what would be considered normal. The primary goal of these policies is to retain power.

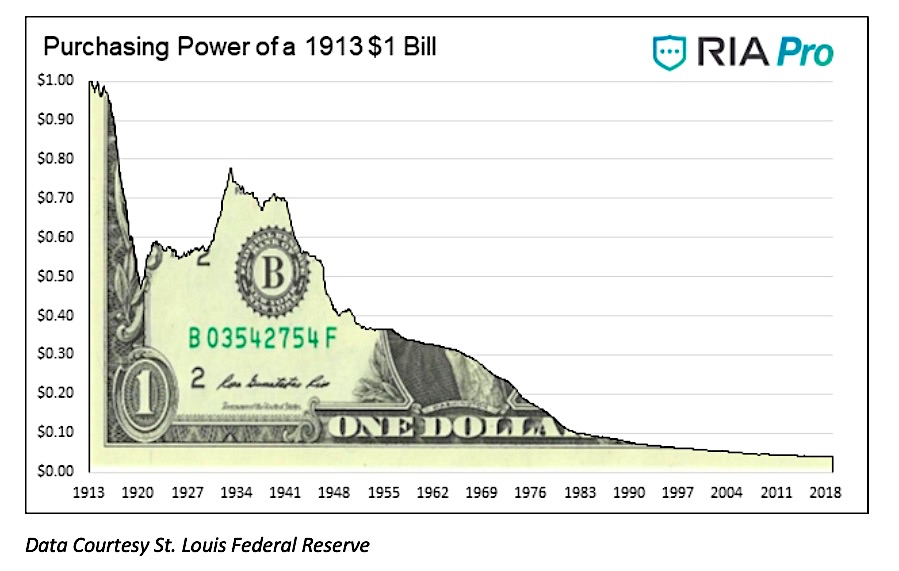

To keep interest rates lower than a healthy market would prescribe, the Fed prints money. When policy consistently leans toward lower than normal rates, as has been the case, the money supply rises. In the wake of the described Fed-Government partnership lies a currency declining in value. As discussed in prior articles, inflation, which damages the value of a currency, is always the result of monetary policy decisions.

If the value of a currency rests on its limited supply, are we now entering a phase where the value of the dollar will begin to get questioned? I don’t have a definitive answer but I know with a strong degree of certainty that the damage is already done and the damage proposed by both political parties increases the odds that the almighty dollar will lose value, and with that, TRUST will erode. Recall the graph of the dollar’s declining purchasing power that I showed in Part 1.

Got Money?

If the value of the dollar and other fiat currencies are under liberal monetary and fiscal policy assault and at risk of losing the valued TRUST on which they are 100% dependent, we must consider protective measures for our hard-earned wealth.

With an underlying appreciation of the TRUST supporting our dollars, the definition of terms becomes critically important. What, precisely, is the difference between currency and money?

Gold is defined as natural element number 79 on the periodic table, but what interests us is not its definition but its use. Although gold is and has been used for many things, its chief purpose throughout the 5,000-year history of civilization has been as money.

In testimony to Congress on December 18, 1912, J.P. Morgan stated: “Money is gold, and nothing else.” Notably, what he intentionally did not say was money is the dollar or the pound sterling. What his statement reveals, which has long since been forgotten, is that people are paid for their labor through a process that is the backbone of our capitalist society. “Money,” properly defined, is a store of labor and only gold is money.

In the same way that cut glass or cubic zirconium may be made to look like diamonds and offer the appearance of wealth, they are not diamonds and are not valued as such. What we commonly confuse for money today – dollars, yen, euro, pounds – are money-substitutes. Under an evolution of legal tender laws since 1933, global fiat currencies have displaced the use of gold as currency. Banker-generated currencies like the dollar and euro are not based on expended labor; they are based on credit. In other words, they do not rely on labor and time to produce anything. Unlike the efforts required to mine gold from the ground, currencies are nearly costless to produce and are purely backed by a promise to deliver value in exchange for labor.

Merchants and workers are willing to accept paper currency in exchange for their goods and services in part because they are required by law to do so. We must TRUST that we are being compensated in a paper currency that will be equally TRUSTed by others, domestically, and internationally. But, unlike money, credit includes the uncertainty of “value” and repayment.

Currency is a bank liability which explains why failing banks with large loan losses are not able to fully redeem the savings of those who have their currency deposited there. Gold does not have that risk as there is no intermediary between it and value (i.e., the U.S. government or the Japanese government). Gold is money and harbors none of these risks, while currency is credit. Said again for emphasis, only gold is money, currency is credit.

There is a reason gold has been the money of choice for the entirety of civilization. The last 90 years is the exception and not the rule.

Despite their actions and words, the value of gold, and disTRUST of the dollar is not lost on Central Bankers. Since 2013, global central banks have bought $140 billion of gold and sold $130 billion of U.S. Treasury bonds. Might we say they are trading TRUST for surety?

Summary

To repeat, currency, whether dollars, pounds, or wampum, are based on nothing more than TRUST. Gold and its 5000 year history as money represents a dependable store of labor and real value; TRUST is not required to hold gold. No currency in the history of humankind, the almighty U.S. dollar included, can boast of the same track record.

TRUST hinges on decision makers who are people of character and integrity and willingness to do what is best for the nation, not the few. Currently, both political parties are taking actions that destroy TRUST to gain votes. While political party narratives are worlds apart, their actions are similar. Deficits do matter because as they accumulate, TRUST withers.

This article is not a call to action to trade all of your currency for gold, but we TRUST this article provokes you to think more about what money is.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.