A special thank you to Peter Cook for co-authoring this article with us.

Imagine an island called Stiltsville, where a person’s value is based solely on their height. In order to increase their value, people living on the island used to wear platform shoes. A person wearing six-inch platform shoes would suddenly be more valuable than a person of similar height who wore normal footwear.

Eventually, platform shoes were replaced by stilts, three-foot stilts were be replaced by six-foot stilts, and so on. People eventually rose to be the height of giraffes.

The main point is that, on an island where height is valued above all else, people will try to game the situation to their advantage by increasing their height by any means available.

People from other lands would look at the people of Stiltsville and recognize their obsession with height greatly distorts their perception of value. They would also likely conclude that distorted perceptions result in actual distortions in productivity, because:

- People waste time and money thinking about how to increase their height, and

- Walking around in platform shoes or stilts does not necessarily increase a person’s productivity, and instead most likely impairs it

Now imagine a world in which the health of an economy is perceived to be based on one metric; Gross Domestic Product (GDP). GDP is simply the total amount of spending in an economy. GDP, as currently measured, does not distinguish between “good” spending and “bad” spending. GDP does not distinguish between consumption spending and investment spending. GDP also does not distinguish whether spending is generated by existing wealth, by going into debt temporarily, or by going into debt permanently. In this world, every dollar spent on education or new means of production is counted the same as every dollar spent on epic bachelor parties and video games.

This world, the world of GDP accounting, is the world we live in. More spending today than occurred yesterday is considered economic growth. Growth, regardless of how it happened or at what cost, is highly sought after by politicians, economists and central bankers.

Gaming the System

Like the island where height is valued above all else, the world in which GDP is valued above all else can easily be gamed, making an economy appear healthier and larger than it really is. Instead of wearing platform shoes or stilts, politicians game GDP by increasing the amount of government spending without necessarily increasing the productivity of the economy. Politicians also tinker with the tax code and provide incentives for the private sector to increase consumption and/or to favor one type of spending over another. Central bankers, who should know better, sit idly by adjusting interest rates, which allows the government’s poor fiscal habits to persist and grow. Neither politicians, economists, nor central bankers have any regard for the quality of spending.

When such irresponsible behavior continues unabated over time, the divergence between the reported GDP and the actual health of an economy grow larger and larger.

Exploring Fiscal Spending

A book could easily be written, and probably has been, on the flaws of GDP and the errors of using GDP as an economic benchmark. To keep this short and get our point across, we will focus solely on the fiscal spending component of GDP. However, make no mistake, a rash of consumer materialism toward bigger houses, more expensive cars and a host of other non-productive spending has led to hollow GDP growth as well.

Because GDP measures all spending in an economy, government spending financed by budget deficits increases the level of GDP. Since much of government spending is not productive as it does not produce a return as large as the initial expenditure, this spending is a shell game which only shifts the timing of spending to ostensibly “produce growth.” Debt-financed spending today pulls consumption forward from tomorrow, but in doing so creates less spending in the future as the obligations to service existing debt grow. If new debt does not provide a revenue stream sufficient to cover the interest cost, then it is non-productive and results in a drag on economic growth. This does not mean all government spending needs to be productive, but non-productive expenses should be paid for with current tax revenue and not debt.

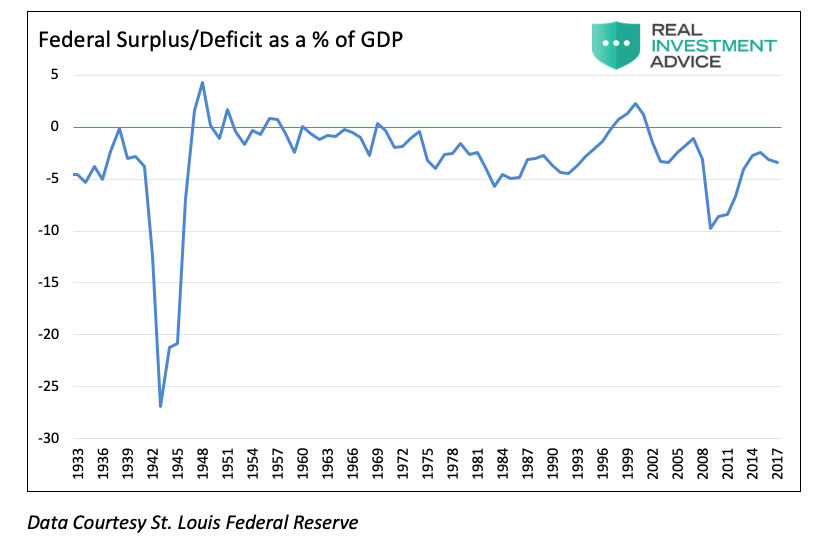

Rational observers understand that politicians elected today seek to deliver benefits to their constituents today. Due to the current nature of politics and the strong motivations to be re-elected, very few politicians seem to care about anything beyond the next election. Since 1960, as shown below, fiscal spending inflated the GDP calculation in all but five years.

The era of consistent deficits began in the 1960’s during President Lyndon Johnson’s “guns and butter” policies. Johnson’s spending habits, while large at the time, pale in comparison to deficit spending since. Politicians have seemingly become addicted to making GDP appear larger than it is by spending more than is received in taxes each year, and by an increasing amount. The result is a charade which values the optics of economic growth over economic prosperity.

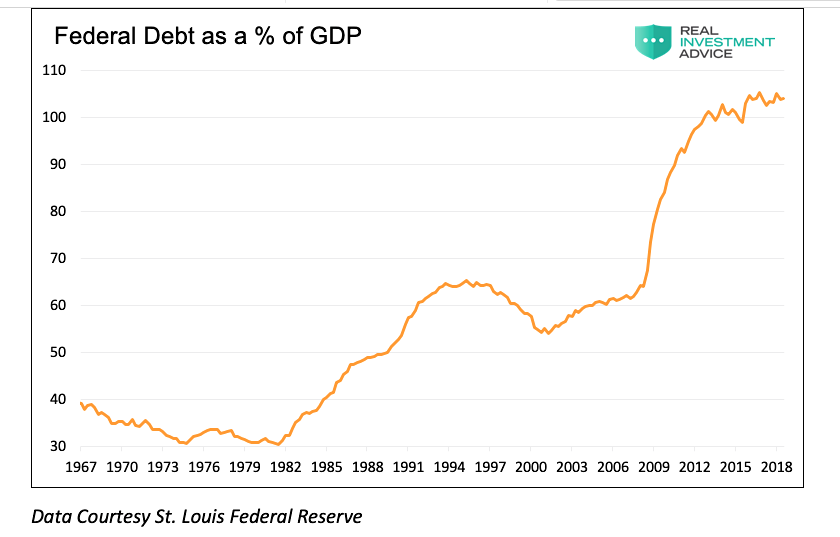

The cumulative effect of the obsession to increase GDP with deficit spending is shown below. As a percentage of GDP, federal debt has tripled over the past 40 years. More recently, deficit spending exploded higher in the wake of the Great Recession of 2008-09. Today, total federal debt outstanding is over $21.5 trillion, exceeding annual GDP of roughly $20.6 trillion. The ratio of debt-to-GDP is currently 104%. Before the 2008/09 recession federal debt was only 60% of GDP.

Summary

In our make-believe island of Stiltsville, where height matters above all else, it will eventually be obvious that 17-foot tall people who cannot easily navigate stairs and doorways are not as valuable as those on bare feet. In time, our world will face the harsh reality that an economy artificially boosted on non-productive spending and over-materialism may temporarily portray greatness in a warped sense, but will be increasingly beset with inevitable economic hardship.

Is deficit spending consequence-free as politicians and central bankers would have us believe? Not if you believe the conclusions of Reinhart and Rogoff, who published “This Time is Different: Eight Centuries of Financial Folly” in 2009. Their exhaustive study of the history of government spending demonstrates that when the ratio of government debt-to-GDP exceeds 90%, economic growth slows and economic problems multiply eventually leading to a financial crisis. Having rejected all forms of fiscal and monetary prudence, U.S. debt-to-GDP far exceeds that level. Either an economic problem lies ahead, or this time really is different.

Finally, consider the following scenario:

Imagine the “GDP” of your family is equal to your family’s spending. Would your financial situation be “better” if:

- It maximizes spending every year, even if it must borrow to do so, or

- It limits spending, and tries to save and invest, subject to what it earns?

Most people would pick #2 understanding the dire consequences that would eventually emerge with option #1. But using the consensus definition of GDP and a “growth at all costs” mentality, economists and politicians have chosen #1. Despite that unpleasant reality, we will all eventually deal with the consequences and share in the responsibility for putting our economic house back in order.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.