The acronym FANG represents what has seemingly become the most popular investment strategy of the last few months. FANG constitutes 4 stocks: Facebook, Amazon, Netflix and Google.

These companies (the FANG stocks) are the markets darlings for good reason; since June they are up on average 40%, whereas the S&P 500 is flat over the same period.

Before you rush to buy these gems we thought it would be helpful to review some basic fundamental data in order to clarify exactly what investors are assuming when they purchase these FANG stocks.

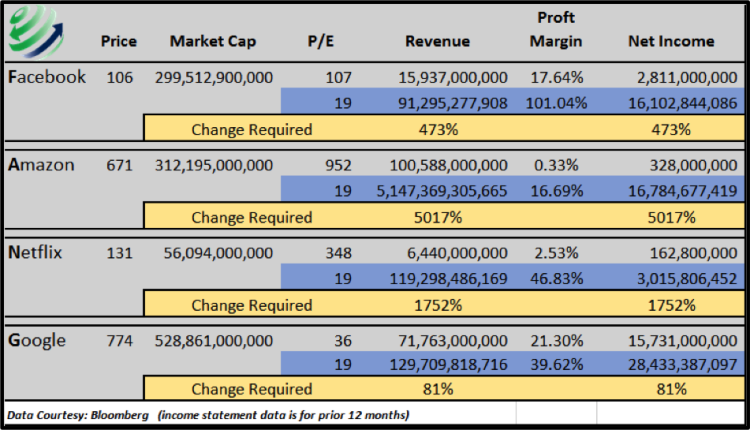

The analysis in the table below reflects the change in revenue, profit margin or income required for these companies to have the same price to earnings (P/E) as the S&P 500. The data highlighted in blue represents the revenue, margin or net income required to bring each P/E to the market average of 18.6. The data in yellow highlights the percentage change required to bring each P/E to the market average.

Are FANG Stocks overvalued?

Company Comments on the FANG stocks

Facebook (FB): Revenues were up 25% year-over-year in the most recent 12 month period but growth is slowing as garnering additional market share becomes increasingly difficult. While deeper market share penetration can certainly be aided with mergers and acquisitions, revenue expectations are tremendous. One has to seriously question the ability of how, what is essentially, an advertising company can generate such growth in what is an extremely competitive and trendy industry.

Amazon (AMZN): The table above shows that Amazon would need to see an astronomical increase in revenue to better justify its valuation. However, one must consider that margins are likely to increase in the future. If we make the huge assumption that they can improve their margins to be similar to those of Walmart (5.5%) Amazon would then still need to almost triple revenue to become fairly valued versus the S&P 500. Increasing their profit margin to 5.50% likely comes at the cost of losing market share thus revenue. Increasing margins in a commoditized business, like Amazon’s, highlight the significant challenges Amazon would have to overcome in order to normalize its P/E ratio. At current margins, revenue and income normalization to the S&P 500 is virtually impossible.

Netflix (NFLX): Netflix needs to achieve over 1,750% revenue growth in order to harmonize its P/E with that of the S&P 500. The large bulk of Netflix’s revenue comes from the monthly subscription fee of $7.99. To put the required revenue growth to normalize their P/E into perspective, Netflix would need to add 590 million new customers and hold on to them for at least 1 year. They currently have 69 million customers. As a point of comparison there are approximately 123 million U.S. households.

Google (GOOGL): In comparison to the other 3 companies, Google is by far the most reasonably priced relative to the P/E of the S&P 500. Its current P/E at 36 is almost double the market but Google’s growth rate is 2-3x that of the markets’. Google is expanding well beyond the search engine/advertising business to create new revenue and income sources. While still overvalued in our opinion, it is clearly not at the eye-watering levels of the other three.

Recommendations and Thoughts

Even though we believe it will be the right call when the market finally comes to its senses, we do not have the iron stomach required to recommend shorting the FANG stocks. However, we do recommend you go FANG-less and let other investors find a greater fool to whom they can sell.

Thanks for reading.

Twitter: @michaellebowitz

The author has no positions in any of the mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.