When we looked around the world at the end of 2014, there were some obvious and mature market trends in place. I say mature because any time the media picks up on something, the cat’s out of the bag. Specifically, the US Dollar was (and is) strong, U.S. Treasury Bonds had an excellent year, and the Russian crisis overtook Greece as the poster child for negative financial news. Below are 5 investing lessons that we should consider when putting together a plan for investing out of situations where things went wrong. Like Russia.

When we looked around the world at the end of 2014, there were some obvious and mature market trends in place. I say mature because any time the media picks up on something, the cat’s out of the bag. Specifically, the US Dollar was (and is) strong, U.S. Treasury Bonds had an excellent year, and the Russian crisis overtook Greece as the poster child for negative financial news. Below are 5 investing lessons that we should consider when putting together a plan for investing out of situations where things went wrong. Like Russia.

1. All that glitters IS Gold – Hold things with intrinsic value

For some reason, Americans view the picture of absolute despair as a store without merchandise to buy. As Crude Oil headed lower and the Russian crisis intensified, we began to see pictures of Russian stores with empty shelves. The empty shelves were the product of both a lack of new goods going into the country and also a rush to purchase anything and everything possible. The media presented the situation as the Russian people wanting to convert their Rubles into tangible items. The real question is whether the people realized their money was worthless and wanted to spend it as quickly as possible or if they were really trying to hedge their currency exposure, but it doesn’t really matter.

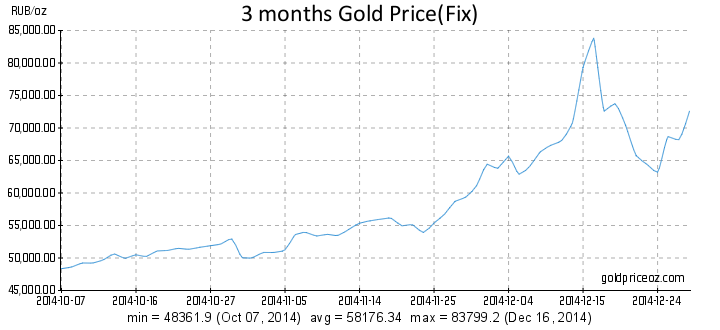

Most people know that Gold, as measured by Dollars, didn’t perform well in 2014. The chart below shows Gold in terms of Rubles over the past three months. Gold has intrinsic value, Dollars and Rubles do not.

Gold Price in terms of Rubles

The lesson is that only things with intrinsic value are “really” worth something… especially when things go wrong. Intrinsic value is the concept that an item has value in and of itself. In other words, it just has value. Things like Real Estate (investable ETF via IYR) and Gold (investable ETF via GLD) have intrinsic value while Fiat Currencies do not. Let me repeat that, when the herd decides that money is worthless, a piece of paper is not wealth. Knowing that, we want to own at least some items that have intrinsic value. Items with intrinsic value are assets and, as we’ll learn from Monopoly next, they have power.

2. Life is like a Monopoly game

Monopoly is a fairly simple, partially luck based game. One of the easier ways to win at Monopoly is to acquire as much property as possible, put up Hotels, and wait for your opponents to go broke. As the game progresses, your opponents will reverse mortgage all of their properties for cash and eventually they’ll still go broke. As this relates to Russia, OPEC is like the person who owns most of the board. OPEC controls roughly 40% of the World Oil output and 60% of the Petroleum traded internationally. To some extent, they can wait for their opponents to go broke.

The take away is that there is power and security in Assets. Additionally, when assets are encumbered by liabilities (as in the case of the mortgaged properties above), they do not have the same power as an asset that is owned outright. The people who hold the majority of the Assets can exert a significant amount of pain on the people with fewer or no Assets. When those Assets are encumbered by liabilities, it’s just a matter of time before the game ends. Ahem, U.S. $18 Trillion in debt and counting.

3. When something goes wrong, other things will follow.

In Russia, we saw things begin to get bad and then they got “really bad.” Initially, it was just the price of Oil falling, but Oil makes up 16% of Russian GDP and 52% of Federal Budget Revenue. When your revenue gets cut in half, bad things usually follow. In Russia, the decrease in the price of Oil created a lack of demand for the currency and the Ruble began to fall. The precipitous loss of value in the national currency began to create doubt about the leadership in the county and Putin’s ability to resolve the situation was questioned.

What we saw is that markets are intertwined and when one thing goes bad, other things are likely to follow. If one market goes strongly in one direction, other markets are likely to move as well. The losses can be significant if a country, or an investor, has too much exposure to one market and something bad happens. As a result, we don’t want too much exposure to any one market without a plan to get out. That leads us to diversification.

4. Diversification and Asset Allocation can help mitigate loss

As we learned above, when something bad happens it can move other related markets in a big way. Additionally, an excessive amount of exposure to one market can have extremely negative consequences. As a result, it’s important to diversify our holdings and market exposure.

ETF performance map – 2014

There are numerous ETF’s available for investing in Foreign Markets, however, choosing the top performing market can be challenging. As you can see from this Map of 2014 international Equity Market Returns, most International Equity Markets were down in 2014 and iShares MSCI Russia (ERUS) was down the most. If we had wanted exposure to Russia in 2014 it would have been better to hold a diversified Emerging Markets ETF (EEM) with some exposure to Russia rather than just Russia.

Click here for an interactive version of the map.

5. Diversification and Asset Allocation are not enough

While Diversification and Asset Allocation help manage risk, they aren’t enough. Sometimes it makes sense to get out of positions and hold Cash or Gold. The major challenge Russia faced with the decline in Crude Oil prices and the Ruble is that the country couldn’t get out and move to cash. As a result, Russia was essentially stuck in a bad trade with a limited amount of diversification.

Individual investors generally have no reason to find themselves stuck in a trade without diversification. Unfortunately, not all investors have a plan for getting out. Investors need to identify the risk in their positions, diversify across markets, hold assets with intrinsic value (if they’re appreciating in price), and always, always have a plan for getting out.

Follow Dan on Twitter: @ThetaTrend

The author holds positions in IYR and related securities RWO, SCHH, and IWM at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.