When stocks were peaking into mid September, Ford (F) was already turning lower. And as the equity markets corrected into October, Ford got hammered. Now stocks are bouncing and Ford is having trouble getting its footing. Could a stronger US Dollar be at the heart of Ford’s woes? Perhaps, but more importantly, the stock is nearing a technical crossroads.

When stocks were peaking into mid September, Ford (F) was already turning lower. And as the equity markets corrected into October, Ford got hammered. Now stocks are bouncing and Ford is having trouble getting its footing. Could a stronger US Dollar be at the heart of Ford’s woes? Perhaps, but more importantly, the stock is nearing a technical crossroads.

Below is a weekly chart dating back to 2009. As you can see, Ford has taken a dive of late. Also alarming is the stock’s relative underperformance to the major equity indices. Since the end of August, Ford is down 20.9%, while the Dow Jones Industrial Average (DJIA) is down just 1.7%.

So what makes this an interesting setup? Well, a few things:

- The stock is nearing trend line support. Clearly, risk is defined in and around trend line support (12.50/13.00).

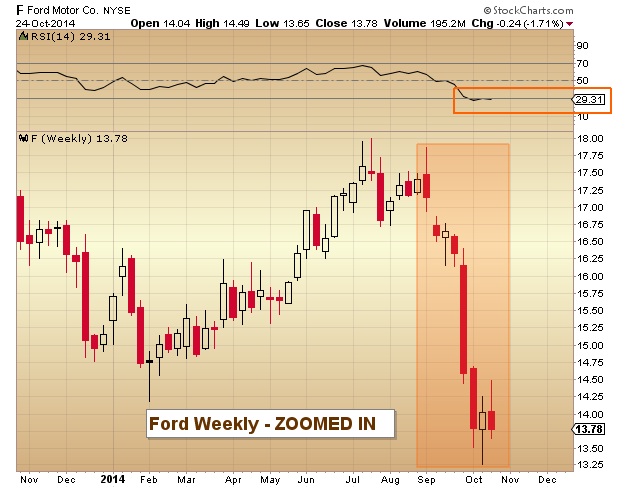

- The stock is oversold (currently under 30 RSI on weekly). Note the daily chart recently dipped under 15 RSI.

- The stock is on bar 8 (this week) of a weekly 9 buy setup (DeMark). This means that although the momentum phase of the drop may be over (a positive), there is still a chance of lower prices over the next two to three weeks.

Ford (F) Weekly Stock Chart

Below is the weekly chart again, just zoomed in on the past year. Ford’s stock got hit again last week, mostly due to Friday’s mixed earnings report. But this is likely a non-event considering that the stock has already fallen over 20 percent in less than 2 months. And many investors are waiting for the launch of the new aluminum Ford F150.

More important will be watching Ford’s price action into year end. How the stock acts from here on out may provide clues on the domestic economy (and European sales), given how sensitive Ford is to economic data. Trade safe.

Follow Andrew on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity. Ford Photo from Chatchai Somwat/123RF.COM.