2019 Stock Market Forecast & Outlook (summary):

– Investors will continue to endure a choppy market into the new year but stock market conditions will likely improve over course of the year with new cyclical bull emerging in second half.

– The Federal Reserve is shifting toward data dependency as interest rates approach neutral level.

– Economic growth is expected to slow though domestic recession risk remains minimal. There’s an upswing in productivity growth providing an unexpected tailwind for the economy.

– S&P 500 (NYSEARCA: SPY) earnings growth may have peaked, but that may not preclude expectations drifting higher, especially on signs of global economic recovery.

– Absent evidence of renewed inflation and improving global conditions, bond yields not likely to move meaningfully higher.

2018 has been a departure from 2017 in many ways. The historical calm of 2017, with its maximum peak-to-trough drawdown on the S&P 500 of a measly 2.8%, faded. It was replaced with a return of volatility (INDEXCBOE: VIX) and as of this writing in early December the S&P 500 has experienced declines of more than 3% on five individual trading days in 2018. This may have caught some investors off guard, but it should not have been a total surprise (especially for anyone who read our 2018 outlook: Clouds Could Test Investor Resolve).

In many ways we have witnessed a return to a more normal volatility environment. Though in other ways, 2018 was extraordinary in its own right. According to Ned Davis Research, 2018 could go down as the first year since at least 1972 that no single asset class produced a return of more than 5%.

The financial market bruising that many experienced was exacerbated by the political bruising endured as we, as a country, slogged through another political cycle. In the wake of the mid-term elections and in an environment of continued partisan tension, it is natural to retreat into our tribal lairs, lick our wounds, and commiserate with like-minded friends and family. We do this in person. We do this across the social media echo chambers we create for ourselves. But we shouldn’t. A better approach would be to engage in civic-mindedness as an ongoing journey rather than a once-every-two-years affair when we show up to vote.We need to expand our boundaries and push into potentially uncomfortable situations – engage, do not withdraw. Growth comes when we challenge ourselves and test the beliefs we hold.

So let’s talk. Not via social media, but in person. Outside the echo chambers. One-to-one. Face-to-face. Let’s listen to each other with an effort to understand, not with the intent to disprove. Let’s take some time to lift our eyes from our phones or other distractions. Be willing to sit quietly in public but seek to engage rather than disappear. Make eye contact. It may not change the world, but it could start a conversation. And who knows where that will take you.

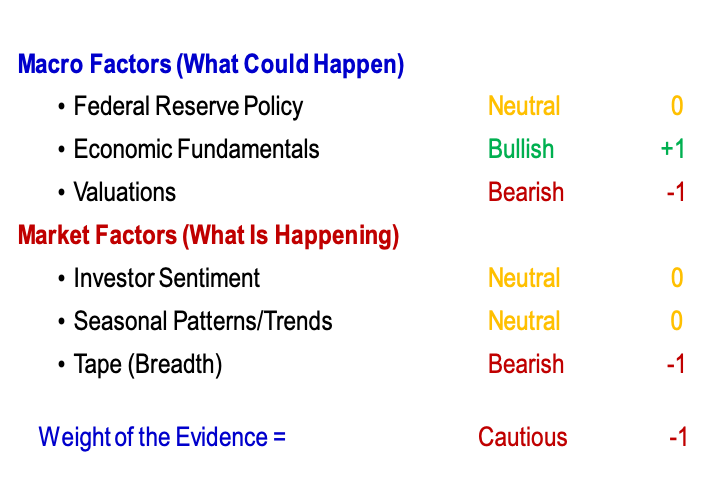

With financial market volatility likely to remain elevated, narratives could continue to get more firmly entrenched. The ability, and willingness, to separate the news from the noise will remain of critical importance for successful investors.To this end, a disciplined approach is more necessary than ever. We rely on our Weight of the Evidence framework as we evaluate risks and opportunities in the financial markets. We will primarily address our outlook for 2019 through the lens of our fundamental factors (what could happen), letting the technical factors (what is happening) provide the necessary feedback and guidance as we move through the year.

Before getting into detail, step back and consider the bigger picture. Financial market volatility that reemerged in 2018 is unlikely to subside just because we move into a new year.Moreover, this volatility has emerged as the cyclical rally off of the early-2016 lows was running out of steam and stocks have moved into what increasingly looks like a cyclical bear market. We will conclude this outlook with some thoughts on what we are looking for as evidence that the bear market has run its course but for now caution remains warranted. As we move into 2019, our base case is that stocks could struggle to make headway in the early going of next year, despite historical seasonal patterns that would argue for strength.

After a period of consolidation and testing, positive divergences could emerge between the broad market and the popular indexes. This scenario rests heavily on the view that the U.S. economy does not slow more than is currently expected and that the global economy shows some ability to surprise to the upside. If so, stocks could rally over the second half of 2019, finishing the year on an upbeat note as a new cyclical bull market emerges.

If, however, deteriorating conditions overseas and Fed tightening at home produce a greater-than-expected downshift in the U.S. economy (20% likely), the cyclical bear market could linger.Under this scenario, a repeat of 2018 in terms of widespread volatility and historically poor performance across asset classes could be seen in 2019.

On the brighter side, the stock market weakness in 2018 could be overestimating the degree to which the economy might slow (20% likely) and a sustainable low in stocks may be more imminent than is now appreciated.If this scenario is playing out, we would expect to see evidence that international and small-cap U.S. stocks are getting in gear and earnings expectations that are drifting higher rather than lower.

Under any of these scenarios, we will listen to the message of the market rather than watch the calendar for evidence that conditions are improving. Sustainable market lows are hard to determine in real-time, but the emergence of meaningful breadth thrusts typically suggest that risks are ebbing.

The degree to which any of those scenarios plays out likely hinges on the development of Federal Reserve Policy, Economic Fundamentalsand Valuationsover the course of 2019.

Federal Reserve Policy:

Under the new leadership of Jerome Powell in 2018, the Fed has continued its course of moving interest rates up to neutral and also shrinking its balance sheet. It raised rates three times over the first three quarters of 2018 and is expected to do so again when it meets in December. At the same time, the pace at which it has drawn down its balance sheet has accelerated over the course of the year, moving toward a $50 billion reduction per month. These actions by the Fed lead an overall shift by central banks around the world away from the quantitative easing of recent years and along a path of quantitative tightening. The uptick in financial market volatility seen in 2018 is likely symptomatic of this new central bank environment as previously ample liquidity becomes more scarce.

The Fed has expressed a desire to let the balance sheet draw-down proceed almost as if on autopilot and so we expect little deviation from the announced course. The path of interest rates, however, is not on a pre-set course. As the Fed Funds rate approaches what is considered to be the neutral rate, further actions by the Fed will be increasingly data dependent. Fed Chairman Powell has sought to distinguish between stock market volatility and vulnerability in an effort to remove (or at least reduce) the perceived support for stock prices (the Fed “Put”) that has been present in the past.His efforts in this regard have been mixed.

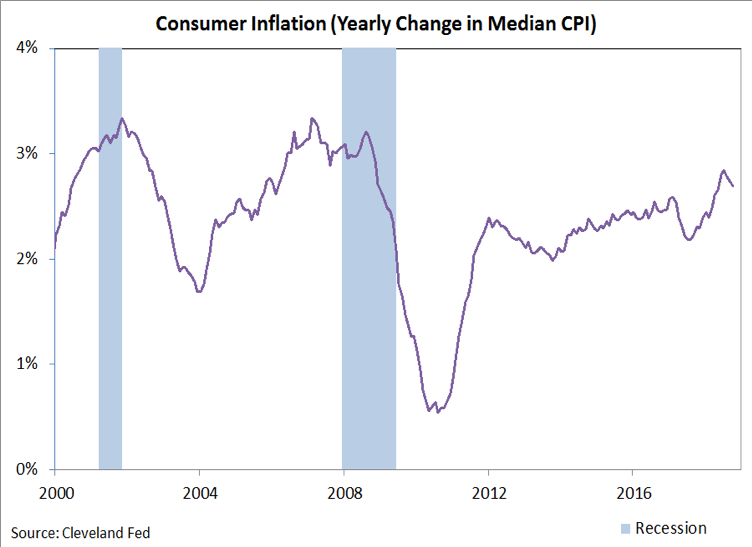

Rather than looking too closely at stock prices, the Fed would be better served watching inflation and growth data, while also monitoring market-determined bond yields, both at home and overseas. If the Fed wants to back away from the path of tightening it expected in the wake of its September meeting, the recent pullback in inflation gauges may provide some leeway for it to do so.

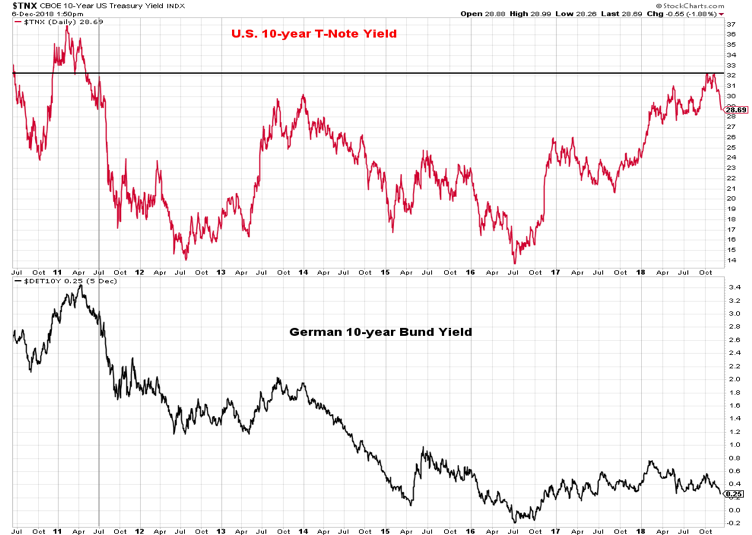

An easing in inflation comes at a time when international turmoil is putting downward pressure on German bond yields, which in turn are putting downward pressure on U.S. bond yields and creating some concern about the yield curve inverting. If yields at the long end of the U.S. curve are being influenced more by international developments than in the past, their relationship to yields at the short end of the curve may be less meaningful suggesting that a modest inversion of the yield curve may not be so worrisome. Powell has described adjusting monetary policy in the current environment as akin to walking around in a cluttered room with no lights on. While his modesty of approach is appreciated, it may not preclude a few stubbed toes along the way.

Economic Fundamentals:

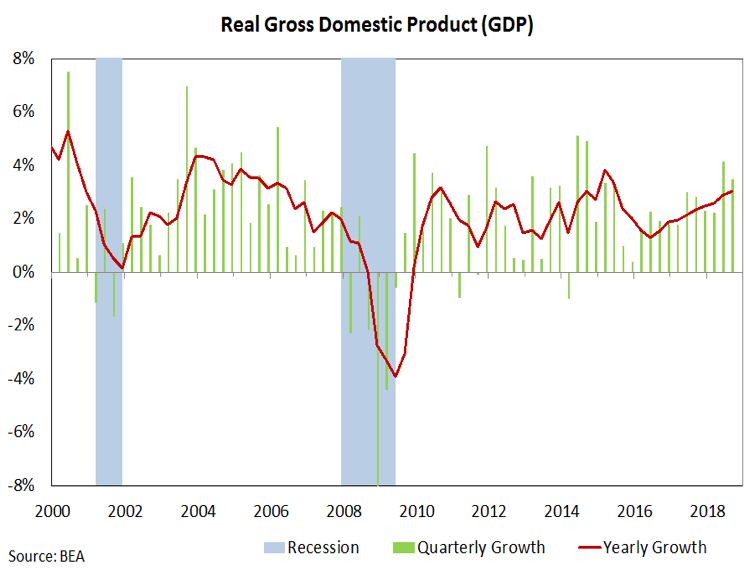

The globally synchronized economic upswing evident in late 2017 disappeared almost as quickly as it emerged. That is one reason that while U.S. bond yields have trended higher over the course of 2018 (getting to a seven-year high in October), German bond yields peaked in January and trended lower over the course of 2018. While the global economy struggled, U.S. economic growth continued to trend higher, posting the best quarterly growth rates seen since 2014.Through the third quarter of 2018, the yearly growth rate in real GDP has risen in eight consecutive quarters.

Entering 2019 there are concerns about the potential impact of potential tariffs and the durability of the recent run-up in GDP growth rates. There is a broad consensus that the growth sugar high of 2018 (fueled by recent tax cuts) will sputter in 2019 and the economy will still be mired in the secular stagnation of the recent past.Arguing against this is the near-universality of this viewpoint as well as the data showing that economic growth bottomed in 2016 and thatthe trend in productivity growth has turned higher for the first time in over a decade. Growth may very well moderate in 2019, but if the underlying trend in growth has shifted, the pullback may be more modest than many forecasters, including the Fed, now anticipate.

We are not forecasters, and we could not model for you the how or why an upswing in growth may have emerged beyond observing a shift in attitude toward more economic risk-taking that is suggested in surveys of consumer and business confidence. This is entirely consistent with John Maynard Keynes’ view that our “positive activities depend on spontaneous optimism rather than mathematical expectations” – in other words, it may just be “animal spirits” at work. If this is the case, than the secular slow growth environment of the past 15 years will fade and a new secular upswing in growth will emerge.After-the-fact rationales will point to any number of factors, not least of which will likely be a long-delayed boost in productivity growth. One key for U.S. growth in 2019 may be the ability of the global economy to emerge from recession and help fuel a resynchronization of growth.

Valuations:

The combination of a pullback in stock prices and upswing in earnings has produced a marked improvement in stock market valuations since the beginning of 2018 (when, based on some measures, stocks were more expensive that at the 2000 or 2007 peaks). While stocks have traded within a broad range for most of the year, earnings growth has accelerated at a time in the cycle when it normally peaks then slows. While the tax cut package that was enacted a year ago helped extend the cycle, earnings have also been buoyed by strong corporate revenue growth (which topped 10% in the second quarter) and record profit-margins (even adjusting for the tax cuts). This past year also witnessed, for the first time in many years, earnings estimates that rose over the course of the year.Again, this was more than just a function of the tax cuts and could be further evidence that an important underlying shift has occurred in the economy.

We have become accustomed to earnings estimates that start at elevated levels only to be revised lower over the course of the year. This pattern is a strong argument against using valuations based on expected earnings even though, as is often cited, the stock market is a forward-looking machine. Similarly, we have become accustomed to forecasted economic growth representing the virtual ceiling for growth. While this has been the case for nearly two decades, the two decades prior to that saw forecasts represent a virtual floor for growth. Forecasts were not more or less correct in either 20-year period – but rather the error in the forecast was skewed differently. If we are entering a period of consistent and persistent better-than-expected growth, it follows that earnings forecast revisions may skew higher in the years ahead rather than lower as in recent years.

As with forecasts for the economy, expectations for earnings are that growth will slow in 2019 (from 27% to 10% on a full year basis). The degree to which they slow will be watched carefully. Expectations for 2019 earnings have begun to be revised lower – if our hypothesis about a secular shift higher in growth is playing out, downward revisions in earnings expectations for 2019 could soon be replaced with revisions that follow an upward trajectory.

Valuations have improved but we would be hard-pressed to suggest they are attractive at current levels. When it comes to the stock market, we base our view on valuations on two basic premises: actual earnings are more useful thanforecasted earnings and longer time frames are more useful than shorter time frames.The tendency of earnings forecasters (like economic forecasters) to be wrong supports the first premise while Keynes’ adage that the market can stay irrational longer than you can stay solvent supports the second. Based on this, valuations remain a headwind for stocks. Further price volatility and/or strong earnings growth in the first half of 2019 could put valuations on a more firm footing for supporting a sustained leg higher within the secular bull market for stocks.Given the valuation headwinds that do still persist, we may be in for an extended period in which the real economy outperforms the financial economy.

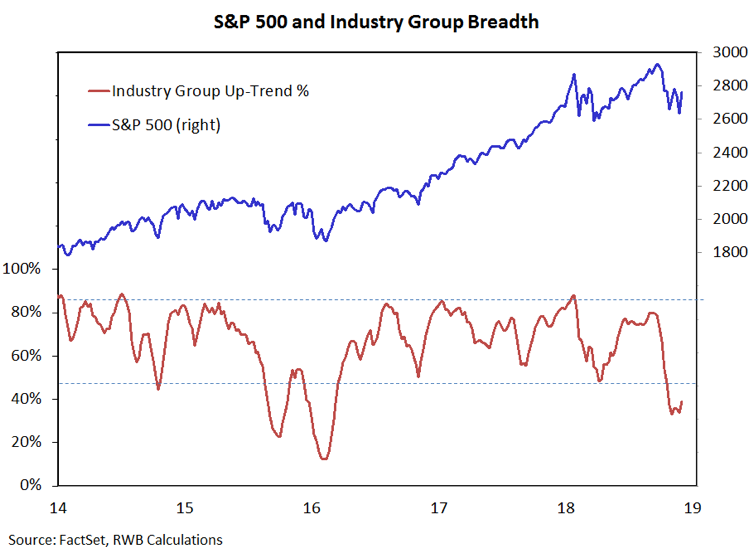

With those ideas as the fundamental backdrop and influences as we enter 2019, we shift gears (slightly) to discuss the cyclical health of the stock market. While summer-time headlines noted gains on some of the popular U.S stock market averages, there was ample evidence that beneath the surface and overseas conditions were deteriorating. New highs on the S&P 500, NASDAQ Composite, and Dow Industrials were occurring within a void of confirming support.Overseas stocks turned lower in the second quarter and many were down on a year-to-date basis even as the U.S. indexes were making new highs. New highs on the indexes came with fewer stocks even still in up-trends. Rather than seeing the new high list expand in confirmation, we witnessed the new low list creeping higher. The volatility that was present in the first quarter of 2018 remerged in the fourth quarter of 2018. Deteriorating breadth and momentum have combined with persistent optimism to help preclude the marking of a meaningful cyclical low in stocks.

As our eyes turn toward 2019 it is useful to review the evidence that has, in the past, been useful in suggesting that selling has gotten ahead of itself and risk may be yielding to opportunity. We would expect to see the following sequence emerge: evidence of widespread pessimism, signs of panic selling, willingness for buyers to step in with conviction. This suggests longer-term optimism likely needs to be unwound, followed by near-term evidence of fear and capitulation, which is then followed by upside volume overwhelming downside volume (or other evidence of a breadth thrust). We move into 2019 hopefully watching for evidence that this sequence of events may be emerging. Beyond this, we are also watching for shifting trends in terms of breadth and leadership. In addition to the emergence of a breadth thrust, a sustainable turn higher for stocks would likely come with an expansion the percentage of industry groups in uptrends as well as resurgent strength in small-caps versus large-caps, cyclical versus defensive sectors, and emerging markets versus developed (including the U.S.) markets.

Expectations aside, until the weight of evidence improves, caution remains warranted.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.